BP 2014 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

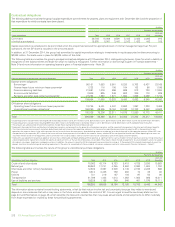

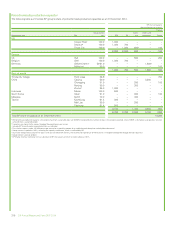

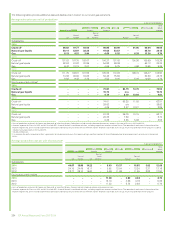

Estimated net proved reserves on an oil equivalent basis

million barrels of oil equivalent

Developed Undeveloped Total

Subsidiaries 5,187 4,507 9,694

Equity-accounted entities 4,548 3,280 7,828

Total 9,735 7,788 17,523

aProved reserves exclude royalties due to others, whether payable in cash or in kind, where the

royalty owner has a direct interest in the underlying production and the option and ability to

make lifting and sales arrangements independently, and include non-controlling interests in

consolidated operations. We disclose our share of reserves held in joint ventures and

associates that are accounted for by the equity method although we do not control these

entities or the assets held by such entities.

bThe 2014 marker prices used were Brent $101.27/bbl (2013 $108.02/bbl and 2012

$111.13/bbl) and Henry Hub $4.31/mmBtu (2013 $3.66/mmBtu and 2012 $2.75/mmBtu).

cIncludes condensate and bitumen.

dProved reserves in the Prudhoe Bay field in Alaska include an estimated 65 million barrels on

which a net profits royalty will be payable over the life of the field under the terms of the BP

Prudhoe Bay Royalty Trust.

eIncludes 21 million barrels of liquids in respect of the 30% non-controlling interest in BP

Trinidad and Tobago LLC.

fIncludes 38 million barrels of crude oil in respect of the 0.16% non-controlling interest in

Rosneft held assets in Russia.

gIncludes 2,519 billion cubic feet of natural gas in respect of the 30% non-controlling interest in

BP Trinidad and Tobago LLC.

hIncludes 91 billion cubic feet of natural gas in respect of the 0.18% non-controlling interest in

Rosneft held assets in Russia.

Because of rounding, some totals may not agree exactly with the sum

of their component parts.

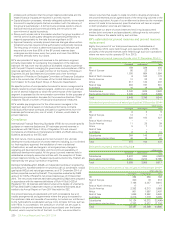

Proved reserves replacement

Total hydrocarbon proved reserves at 31 December 2014, on an oil

equivalent basis including equity-accounted entities, decreased by 3%

(decrease of 5% for subsidiaries and increase of 1% for equity-

accounted entities) compared with 31 December 2013. Natural gas

represented about 44% (58% for subsidiaries and 27% for equity-

accounted entities) of these reserves. The change includes a net

decrease from acquisitions and disposals of 39mmboe (all within our

subsidiaries). Acquisition activity in our subsidiaries occurred in

Azerbaijan, the US and the UK, and divestment activity in our

subsidiaries in the US and Brazil.

The proved reserves replacement ratio is the extent to which

production is replaced by proved reserves additions. This ratio is

expressed in oil equivalent terms and includes changes resulting from

revisions to previous estimates, improved recovery, and extensions and

discoveries. For 2014, the proved reserves replacement ratio excluding

acquisitions and disposals was 63% (129% in 2013 and 77% in 2012)

for subsidiaries and equity-accounted entities, 29% for subsidiaries

alone and 116% for equity-accounted entities alone. The decreased

ratio reflected lower reserves bookings as a result of fewer final

investment decisions in 2014 and revisions of previous estimates.

In 2014 net additions to the group’s proved reserves (excluding

production and sales and purchases of reserves-in-place) amounted to

743mmboe (208mmboe for subsidiaries and 535mmboe for equity-

accounted entities), through revisions to previous estimates, improved

recovery from, and extensions to, existing fields and discoveries of new

fields. The subsidiary additions through improved recovery from, and

extensions to, existing fields and discoveries of new fields were in

existing developments where they represented a mixture of proved

developed and proved undeveloped reserves. Volumes added in 2014

principally resulted from the application of conventional technologies.

The principal proved reserves additions in our subsidiaries were in

Angola, Azerbaijan, Iraq, Oman, Trinidad and the US. We had material

reductions in our proved reserves in Norway, the UK, Indonesia and

Australia, principally due to activity reduction and reservoir performance.

The principal reserves additions in our equity-accounted entities were in

Argentina and Russia.

Sixteen per cent of our proved reserves are associated with PSAs. The

countries in which we operated under PSAs in 2014 were Algeria,

Angola, Azerbaijan, Egypt, India, Indonesia, Oman and a non-material

volume of our proved reserves in Trinidad. In addition, the technical

service contract (TSC) governing our investment in the Rumaila field in

Iraq functions as a PSA.

The Abu Dhabi onshore concession expired in January 2014 with a

consequent reduction in production of approximately 140mboe/d. Our

Abu Dhabi offshore concession is due to expire in 2018. The group

holds no other licences due to expire within the next three years that

would have a significant impact on BP’s reserves or production.

For further information on our reserves see page 174.

Additional disclosures

*Defined on page 252. BP Annual Report and Form 20-F 2014 221