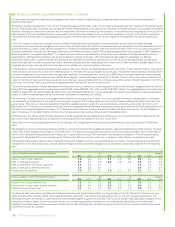

BP 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

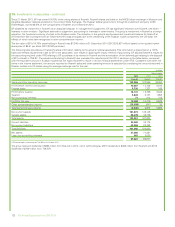

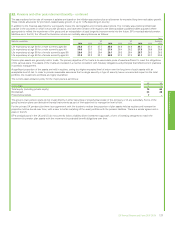

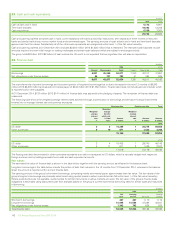

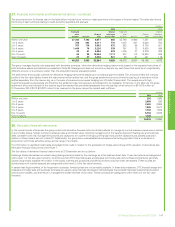

23. Cash and cash equivalents

$ million

2014 2013

Cash at bank and in hand 5,112 6,907

Term bank deposits 18,392 12,246

Cash equivalents 6,259 3,367

29,763 22,520

Cash and cash equivalents comprise cash in hand; current balances with banks and similar institutions; term deposits of three months or less with

banks and similar institutions; money market funds and commercial paper. The carrying amounts of cash at bank and in hand and term bank deposits

approximate their fair values. Substantially all of the other cash equivalents are categorized within level 1 of the fair value hierarchy.

Cash and cash equivalents at 31 December 2014 includes $2,264 million (2013 $1,626 million) that is restricted. The restricted cash balances include

amounts required to cover initial margin on trading exchanges and certain cash balances which are subject to exchange controls.

The group holds $3 billion (2013 $2 billion) of cash outside the UK and it is not expected that any significant tax will arise on repatriation.

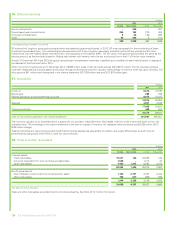

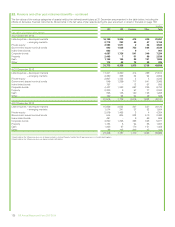

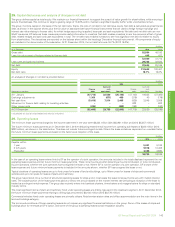

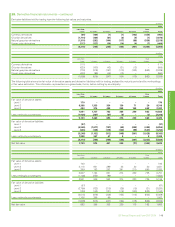

24. Finance debt

$ million

2014 2013

Current Non-current Total Current Non-current Total

Borrowings 6,831 45,240 52,071 7,340 40,317 47,657

Net obligations under finance leases 46 737 783 41 494 535

6,877 45,977 52,854 7,381 40,811 48,192

The main elements of current borrowings are the current portion of long-term borrowings that is due to be repaid in the next 12 months of $6,343

million (2013 $6,230 million) and issued commercial paper of $444 million (2013 $1,050 million). Finance debt does not include accrued interest, which

is reported within other payables.

At 31 December 2014, $137 million (2013 $141 million) of finance debt was secured by the pledging of assets. The remainder of finance debt was

unsecured.

The following table shows the weighted average interest rates achieved through a combination of borrowings and derivative financial instruments

entered into to manage interest rate and currency exposures.

Fixed rate debt Floating rate debt Total

Weighted

average

interest

rate

%

Weighted

average

time for

which rate

is fixed

Years

Amount

$ million

Weighted

average

interest

rate

%

Amount

$ million

Amount

$ million

2014

US dollar 3 3 14,285 1 36,275 50,560

Other currencies 6 19 871 1 1,423 2,294

15,156 37,698 52,854

2013

US dollar 3 4 16,405 1 29,740 46,145

Other currencies 4 11 611 2 1,436 2,047

17,016 31,176 48,192

The floating rate debt denominated in other currencies represents euro debt not swapped to US dollars, which is naturally hedged with respect to

foreign currency risk by holding equivalent euro cash and cash equivalent amounts.

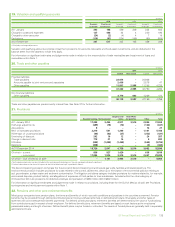

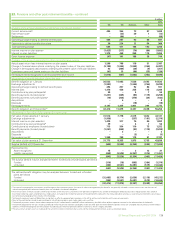

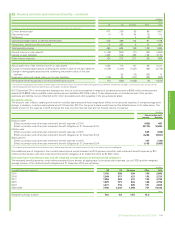

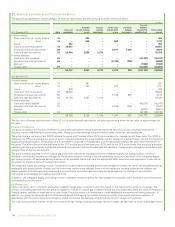

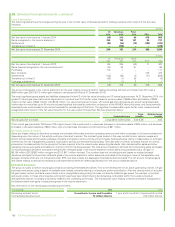

Fair values

The estimated fair value of finance debt is shown in the table below together with the carrying amount as reflected in the balance sheet.

Long-term borrowings in the table below include the portion of debt that matures in the 12 months from 31 December 2014, whereas in the balance

sheet the amount is reported within current finance debt.

The carrying amount of the group’s short-term borrowings, comprising mainly commercial paper, approximates their fair value. The fair values of the

group’s long-term borrowings are principally determined using quoted prices in active markets (and so fall within level 1 of the fair value hierarchy).

Where quoted prices are not available, quoted prices for similar instruments in active markets are used. The fair value of the group’s finance lease

obligations is estimated using discounted cash flow analyses based on the group’s current incremental borrowing rates for similar types and maturities

of borrowing.

$ million

2014 2013

Fair

value

Carrying

amount Fair value

Carrying

amount

Short-term borrowings 487 487 1,110 1,110

Long-term borrowings 51,995 51,584 47,398 46,547

Net obligations under finance leases 1,343 783 654 535

Total finance debt 53,825 52,854 49,162 48,192

142 BP Annual Report and Form 20-F 2014