BP 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

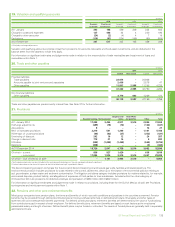

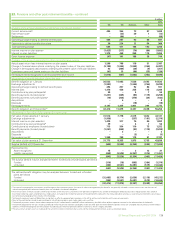

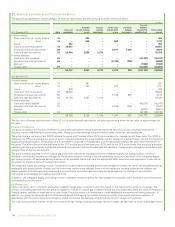

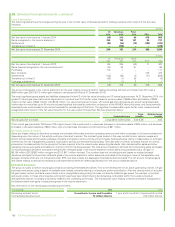

27. Financial instruments and financial risk factors – continued

(i) Commodity price risk

The group’s integrated supply and trading function uses conventional financial and commodity instruments and physical cargoes and pipeline positions

available in the related commodity markets. Oil and natural gas swaps, options and futures are used to mitigate price risk. Power trading is undertaken

using a combination of over-the-counter forward contracts and other derivative contracts, including options and futures. This activity is on both a

standalone basis and in conjunction with gas derivatives in relation to gas-generated power margin. In addition, NGLs are traded around certain US

inventory locations using over-the-counter forward contracts in conjunction with over-the-counter swaps, options and physical inventories.

The group measures market risk exposure arising from its trading positions in liquid periods using value-at-risk techniques. These techniques make a

statistical assessment of the market risk arising from possible future changes in market prices over a one-day holding period. The value-at-risk measure

is supplemented by stress testing. Trading activity occurring in liquid periods is subject to value-at-risk limits for each trading activity and for this trading

activity in total. The board has delegated a limit of $100 million value at risk in support of this trading activity. Alternative measures are used to monitor

exposures which are outside liquid periods and which cannot be actively risk-managed.

In addition, the group has embedded derivatives relating to certain natural gas contracts. The net fair value of these contracts was a liability of

$214 million at 31 December 2014 (2013 liability of $652 million). For these embedded derivatives the sensitivity of the net fair value to an immediate

10% favourable or adverse change in each key assumption is less than $100 million in each case.

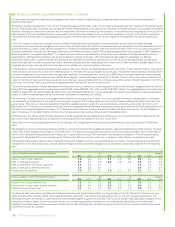

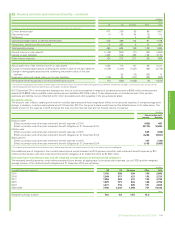

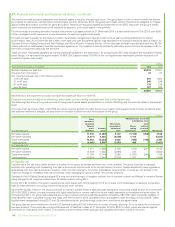

(ii) Foreign currency exchange risk

Where the group enters into foreign currency exchange contracts for entrepreneurial trading purposes the activity is controlled using trading value-at-

risk techniques as explained above.

Since BP has global operations, fluctuations in foreign currency exchange rates can have a significant effect on the group’s reported results. The

effects of most exchange rate fluctuations are absorbed in business operating results through changing cost competitiveness, lags in market

adjustment to movements in rates and translation differences accounted for on specific transactions. For this reason, the total effect of exchange rate

fluctuations is not identifiable separately in the group’s reported results. The main underlying economic currency of the group’s cash flows is the

US dollar. This is because BP’s major product, oil, is priced internationally in US dollars. BP’s foreign currency exchange management policy is to limit

economic and material transactional exposures arising from currency movements against the US dollar. The group co-ordinates the handling of foreign

currency exchange risks centrally, by netting off naturally-occurring opposite exposures wherever possible, and then managing any material residual

foreign currency exchange risks.

The group manages these exposures by constantly reviewing the foreign currency economic value at risk and aims to manage such risk to keep the

12-month foreign currency value at risk below $400 million. At no point over the past three years did the value at risk exceed the maximum risk limit.

The most significant exposures relate to capital expenditure commitments and other UK and European operational requirements, for which a hedging

programme is in place and hedge accounting is claimed as outlined in Note 28.

For highly probable forecast capital expenditures the group locks in the US dollar cost of non-US dollar supplies by using currency forwards and futures.

The main exposures are sterling, euro, Norwegian krone, Australian dollar and Korean won. At 31 December 2014 the most significant open contracts

in place were for $321 million sterling (2013 $723 million sterling).

For other UK, European and Australian operational requirements the group uses cylinders (purchased call and sold put options) to manage the

estimated exposures on a 12-month rolling basis. At 31 December 2014, the open positions relating to cylinders consisted of receive sterling, pay US

dollar cylinders for $2,787 million (2013 $2,770 million); receive euro, pay US dollar cylinders for $867 million (2013 $962 million); receive Australian

dollar, pay US dollar cylinders for $418 million (2013 $401 million).

In addition, most of the group’s borrowings are in US dollars or are hedged with respect to the US dollar. At 31 December 2014, the total foreign

currency net borrowings not swapped into US dollars amounted to $871 million (2013 $665 million).

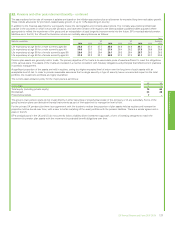

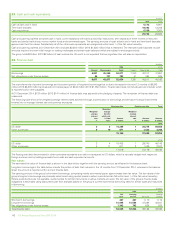

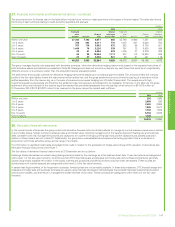

(iii) Interest rate risk

Where the group enters into money market contracts for entrepreneurial trading purposes the activity is controlled using value-at-risk techniques as

described above.

BP is also exposed to interest rate risk from the possibility that changes in interest rates will affect future cash flows or the fair values of its financial

instruments, principally finance debt. While the group issues debt in a variety of currencies based on market opportunities, it uses derivatives to swap

the debt to a floating rate exposure, mainly to US dollar floating, but in certain defined circumstances maintains a US dollar fixed rate exposure for a

proportion of debt. The proportion of floating rate debt net of interest rate swaps at 31 December 2014 was 71% of total finance debt outstanding

(2013 65%). The weighted average interest rate on finance debt at 31 December 2014 was 2% (2013 2%) and the weighted average maturity of fixed

rate debt was four years (2013 four years).

The group’s earnings are sensitive to changes in interest rates on the floating rate element of the group’s finance debt. If the interest rates applicable

to floating rate instruments were to have increased by one percentage point on 1 January 2015, it is estimated that the group’s finance costs for 2015

would increase by approximately $377 million (2013 $312 million increase).

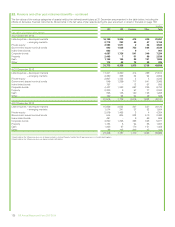

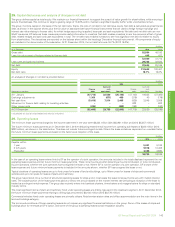

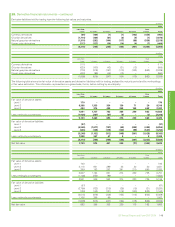

(b) Credit risk

Credit risk is the risk that a customer or counterparty to a financial instrument will fail to perform or fail to pay amounts due causing financial loss tothe

group and arises from cash and cash equivalents, derivative financial instruments and deposits with financial institutions and principally from credit

exposures to customers relating to outstanding receivables. Credit exposure also exists in relation to guarantees issued by group companies under

which amounts outstanding at 31 December 2014 were $83 million (2013 $199 million) in respect of liabilities of joint ventures and associates and

$244 million (2013 $305 million) in respect of liabilities of other third parties.

The group has a credit policy, approved by the CFO, that is designed to ensure that consistent processes are in place throughout the group to measure

and control credit risk. Credit risk is considered as part of the risk-reward balance of doing business. On entering into any business contract the extent

to which the arrangement exposes the group to credit risk is considered. Key requirements of the policy include segregation of credit approval

authorities from any sales, marketing or trading teams authorized to incur credit risk; the establishment of credit systems and processes to ensure that

all counterparty exposure is rated and that all counterparty exposure and limits can be monitored and reported; and the timely identification and

reporting of any non-approved credit exposures and credit losses. While each segment is responsible for its own credit risk management and reporting

consistent with group policy, the treasury function holds group-wide credit risk authority and oversight responsibility for exposure to banks and financial

institutions.

Financial statements

BP Annual Report and Form 20-F 2014 145