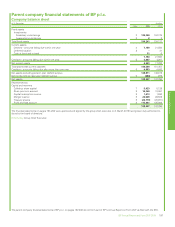

BP 2014 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

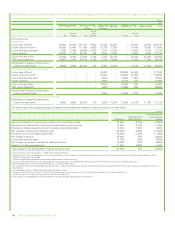

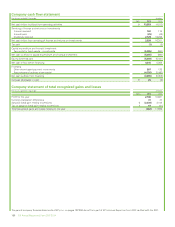

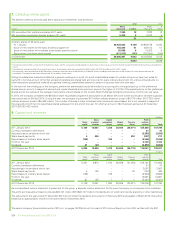

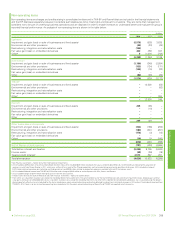

4. Debtors

$ million

2014 2013

Within

1 year

Within

1year

Group undertakings 7,159 21,550

7,159 21,550

The carrying amounts of debtors approximate their fair value.

5. Creditors

$ million

2014 2013

Within

1 year

After

1 year

Within

1year

After

1year

Group undertakings 2,476 4,563 2,526 4,584

Accruals and deferred income 391 90 1,540 58

Other creditors ––201 –

2,867 4,653 4,267 4,642

The carrying amounts of creditors approximate their fair value.

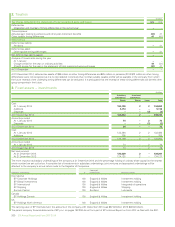

Amounts falling due after one year include $4,236 million (2013 $4,236 million), payable to a group undertaking. This amount is subject to interest

payable quarterly at LIBOR plus 55 basis points.

The maturity profile of the financial liabilities included in the balance sheet at 31 December is shown in the table below. These amounts are included

within Creditors – amounts falling due after more than one year, and are denominated in US dollars.

$ million

2014 2013

Due within

1 to 2 years 404 372

2 to 5 years 13 22

More than 5 years 4,236 4,248

4,653 4,642

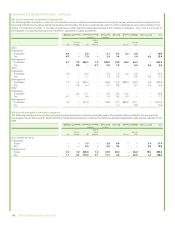

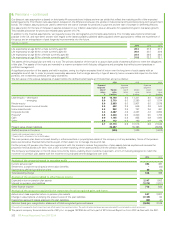

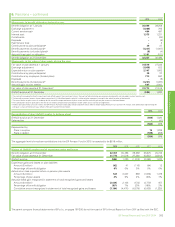

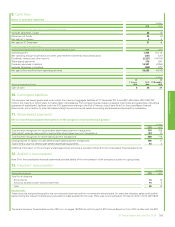

6. Pensions

The primary pension arrangement in the UK is a funded final salary pension plan under which retired employees draw the majority of their benefit as an

annuity. This pension plan is governed by a corporate trustee whose board is composed of four member-nominated directors, four company-nominated

directors, including an independent director and an independent chairman nominated by the company. The trustee board is required by law to act in the

best interests of the plan participants and is responsible for setting certain policies, such as investment policies of the plan. The UK plan is closed to new

joiners but remains open to ongoing accrual for current members. New joiners in the UK are eligible for membership of a defined contribution plan.

For the primary UK plan there is a funding agreement between the company and the trustee. On an annual basis the latest funding position is reviewed

and a schedule of contributions covering the next five years is agreed. The funding agreement can be terminated unilaterally by either party with two

years’ notice. The minimum funding requirement therefore represents seven years of future contributions, which amounted to $4,720 million at 31

December 2014. There are no such minimum funding requirements after this seven-year period, and the obligation is taken into account in the

determination of the amount of any pension plan surplus recognized on the balance sheet.

The obligation and cost of providing the pension benefits is assessed annually using the projected unit credit method. The date of the most recent

actuarial review was 31 December 2014. The principal plans are subject to a formal actuarial valuation every three years in the UK. The most recent

formal actuarial valuation of the main UK pension plan was as at 31 December 2011, and a valuation as at 31 December 2014 is currently under way.

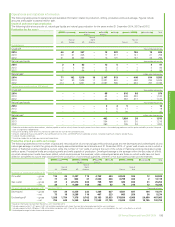

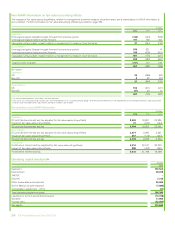

The material financial assumptions used for estimating the benefit obligations of the plans are set out below. The assumptions are reviewed by

management at the end of each year, and are used to evaluate accrued pension benefits at 31 December and pension expense for the following year.

Financial assumptions used to determine benefit obligation %

2014 2013 2012

Discount rate for pension plan liabilities 3.6 4.6 4.4

Rate of increase in salaries 4.5 5.1 4.9

Rate of increase for pensions in payment 3.0 3.3 3.1

Rate of increase in deferred pensions 3.0 3.3 3.1

Inflation for pension plan liabilities 3.0 3.3 3.1

Financial assumptions used to determine benefit expense %

2014 2013 2012

Discount rate for pension plan service costs 4.8 4.4 4.8

Discount rate for pension plan other finance expense 4.6 4.4 4.8

Expected long-term rate of return 6.9 6.9 6.9

Inflation for pension plan service costs 3.4 3.1 3.2

The parent company financial statements of BP p.l.c. on pages 197-206 do not form part of BP’s Annual Report on Form 20-F as filed with the SEC.

Financial statements

BP Annual Report and Form 20-F 2014 201