BP 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30. Capital and reserves – continued

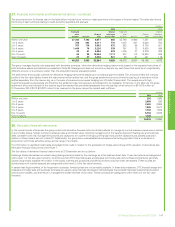

The pre-tax amounts of each component of other comprehensive income, and the related amounts of tax, are shown in the table below.

$ million

2014

Pre-tax Tax Net of tax

Items that may be reclassified subsequently to profit or loss

Currency translation differences (including recycling) (6,787) (178) (6,965)

Cash flow hedges (including recycling) (239) 36 (203)

Share of items relating to equity-accounted entities, net of tax (2,584) – (2,584)

Other – 289 289

Items that will not be reclassified to profit or loss

Remeasurements of the net pension and other post-retirement benefit liability or asset (4,590) 1,334 (3,256)

Share of items relating to equity-accounted entities, net of tax 4–4

Other comprehensive income (14,196) 1,481 (12,715)

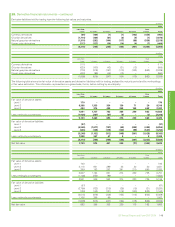

$ million

2013

Pre-tax Tax Netoftax

Items that may be reclassified subsequently to profit or loss

Currency translation differences (including recycling) (1,586) (32) (1,618)

Available-for-sale investments (including recycling) (695) 10 (685)

Cash flow hedges (including recycling) (1,979) 194 (1,785)

Share of items relating to equity-accounted entities, net of tax (24) – (24)

Other – (25) (25)

Items that will not be reclassified to profit or loss

Remeasurements of the net pension and other post-retirement benefit liability or asset 4,764 (1,521) 3,243

Share of items relating to equity-accounted entities, net of tax 2 – 2

Other comprehensive income 482 (1,374) (892)

$ million

2012

Pre-tax Tax Netoftax

Items that may be reclassified subsequently to profit or loss

Currency translation differences (including recycling) 470 146 616

Available-for-sale investments (including recycling) 305 (9) 296

Cash flow hedges (including recycling) 1,547 (330) 1,217

Share of items relating to equity-accounted entities, net of tax (39) – (39)

Other –2323

Items that will not be reclassified to profit or loss

Remeasurements of the net pension and other post-retirement benefit liability or asset (1,572) 440 (1,132)

Share of items relating to equity-accounted entities, net of tax (6) – (6)

Other comprehensive income 705 270 975

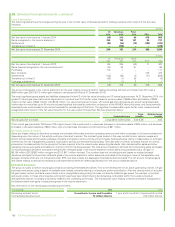

31. Contingent liabilities

Contingent liabilities related to the Gulf of Mexico oil spill

Details of contingent liabilities related to the Gulf of Mexico oil spill are set out in Note 2.

Contingent liabilities not related to the Gulf of Mexico oil spill

There were contingent liabilities at 31 December 2014 in respect of guarantees and indemnities entered into as part of the ordinary course of the

group‘s business. No material losses are likely to arise from such contingent liabilities. Further information is included in Note 27.

Lawsuits arising out of the Exxon Valdez oil spill in Prince William Sound, Alaska, in March 1989 were filed against Exxon (now ExxonMobil), Alyeska

Pipeline Service Company (Alyeska), which operates the oil terminal at Valdez, and the other oil companies that own Alyeska. Alyeska initially

responded to the spill until the response was taken over by Exxon. BP owns a 46.9% interest (reduced during 2001 from 50% by a sale of 3.1% to

Phillips) in Alyeska through a subsidiary of BP America Inc. and briefly indirectly owned a further 20% interest in Alyeska following BP‘s combination

with Atlantic Richfield Company (Atlantic Richfield). Alyeska and its owners have settled all the claims against them under these lawsuits. Exxon has

indicated that it may file a claim for contribution against Alyeska for a portion of the costs and damages that Exxon has incurred. BP will defend any

such claims vigorously. It is not possible to estimate any financial effect.

In the normal course of the group‘s business, legal proceedings are pending or may be brought against BP group entities arising out of current and past

operations, including matters related to commercial disputes, product liability, antitrust, commodities trading, premises-liability claims, consumer protection,

general environmental claims and allegations of exposures of third parties to toxic substances, such as lead pigment in paint, asbestos and other chemicals.

BP believes that the impact of these legal proceedings on the group‘s results of operations, liquidity or financial position will not be material.

With respect to lead pigment in paint in particular, Atlantic Richfield, a subsidiary of BP, has been named as a co-defendant in numerous lawsuits

brought in the US alleging injury to persons and property. Although it is not possible to predict the outcome of the legal proceedings, Atlantic Richfield

believes it has valid defences that render the incurrence of a liability remote; however, the amounts claimed and the costs of implementing the

remedies sought in the various cases could be substantial. The majority of the lawsuits have been abandoned or dismissed against Atlantic Richfield.

No lawsuit against Atlantic Richfield has been settled nor has Atlantic Richfield been subject to a final adverse judgment in any proceeding. Atlantic

Richfield intends to defend such actions vigorously.

Financial statements

BP Annual Report and Form 20-F 2014 157