BP 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

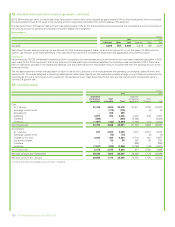

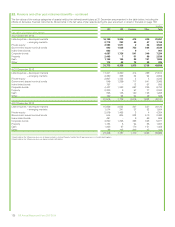

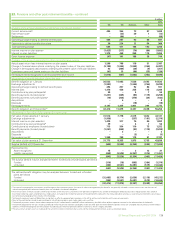

15. Investments in associates – continued

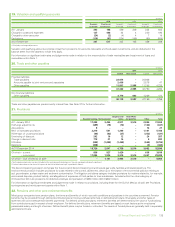

Summarized financial information for the group’s share of associates is shown below. Income statement and other comprehensive income information

shown below includes data relating to associates classified as assets held for sale during the period prior to their classification as assets held for sale.

$ million

BP share

2014 2013 2012

RosneftaOther Total Rosneft OtherbTotal TNK-BP Other Total

Sales and other operating revenues 28,214 9,724 37,938 24,266 12,998 37,264 24,675 11,965 36,640

Profit before interest and taxation 3,825 938 4,763 2,786 908 3,694 4,405 906 5,311

Finance costs 1,033 7 1,040 264 11 275 84 16 100

Profit before taxation 2,792 931 3,723 2,522 897 3,419 4,321 890 5,211

Taxation 677 230 907 422 213 635 979 201 1,180

Non-controlling interests 14 – 14 42 – 42 356 – 356

Profit for the year 2,101 701 2,802 2,058 684 2,742 2,986 689 3,675

Other comprehensive income (2,575) 10 (2,565) (87) 2 (85) 13 (6) 7

Total comprehensive income (474) 711 237 1,971 686 2,657 2,999 683 3,682

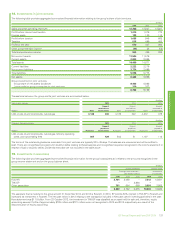

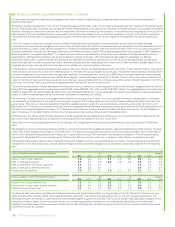

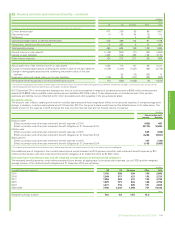

Non-current assets 19,962 2,975 22,937 29,457 3,148 32,605

Current assets 7,560 2,199 9,759 9,633 2,477 12,110

Total assets 27,522 5,174 32,696 39,090 5,625 44,715

Current liabilities 7,189 1,614 8,803 8,527 2,114 10,641

Non-current liabilities 12,890 921 13,811 16,483 1,053 17,536

Total liabilities 20,079 2,535 22,614 25,010 3,167 28,177

Net assets 7,443 2,639 10,082 14,080 2,458 16,538

Less: non-controlling interests 131 – 131 399 – 399

7,312 2,639 9,951 13,681 2,458 16,139

Group investment in associates

Group share of net assets (as above) 7,312 2,639 9,951 13,681 2,458 16,139

Loans made by group companies to

associates – 452 452 – 497 497

7,312 3,091 10,403 13,681 2,955 16,636

aOn 1 October 2014, Rosneft adopted hedge accounting in relation to a portion of highly probable future export revenue denominated in US dollars. Since 1 October 2014, foreign exchange gains and

losses arising on the retranslation of borrowings denominated in currencies other than the Russian rouble and designated as hedging instruments have been recognized initially in other comprehensive

income, and will be reclassified to the income statement as the hedged revenue is recognized over the next five years.

bAn amendment has been made to the amount previously disclosed for Sales and other operating revenues.

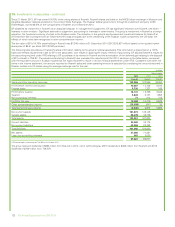

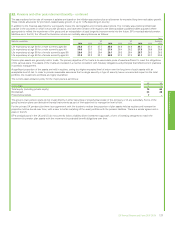

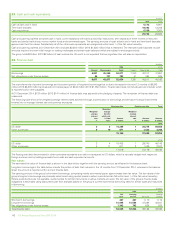

Transactions between the group and its associates are summarized below.

$ million

Sales to associates 2014 2013 2012

Product Sales

Amount

receivable at

31 December Sales

Amount

receivable at

31 December Sales

Amount

receivable at

31 December

LNG, crude oil and oil products, natural gas 9,589 1,258 5,170 783 3,771 401

$ million

Purchases from associates 2014 2013 2012

Product Purchases

Amount

payable at

31 December Purchases

Amount

payable at

31 December Purchases

Amount

payable at

31 December

Crude oil and oil products, natural gas, transportation tariff 22,703 2,307 21,205 3,470 9,135 932

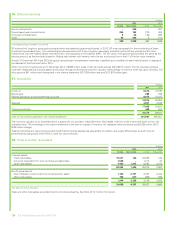

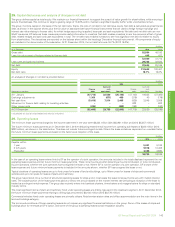

The terms of the outstanding balances receivable from associates are typically 30 to 45 days. The balances are unsecured and will be settled in cash.

There are no significant provisions for doubtful debts relating to these balances and no significant expense recognized in the income statement in

respect of bad or doubtful debts. Dividends receivable are not included in the table above.

BP has commitments amounting to $6,946 million (2013 $6,077 million) in relation to contracts with its associates for the purchase of crude oil and oil

products, transportation and storage.

The majority of the sales to, purchases from, and commitments in relation to contracts with associates relate to crude oil and oil products transactions

with Rosneft.

Financial statements

BP Annual Report and Form 20-F 2014 133