BP 2014 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• In March BP completed the purchase of an additional 3.33% equity in

Shah Deniz and the South Caucasus Pipeline (SCP) from Statoil for

$469 million.

• A ceremony to mark the groundbreaking for the Southern Gas Corridor

was held in September as part of the BP-operated Azerbaijan

International Operating Company celebration of the 20th anniversary of

the Azeri-Chirag-Gunashli production-sharing contract. This is a

milestone in the realization of the Shah Deniz Stage 2 project, which is

planned to deliver gas through the Southern Corridor comprising some

3,500 kilometres of pipeline to customers in Georgia, Turkey, Greece,

Bulgaria and Italy.

• In December BP and the State Oil Company of the Republic of

Azerbaijan signed a new PSA to jointly explore for and develop

potential prospects in the shallow water area around the Absheron

Peninsula in the Azerbaijan sector of the Caspian Sea.

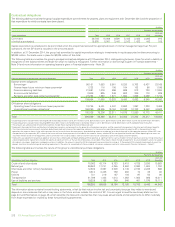

BP, as operator, holds a 30.1% interest in and manages the Baku-Tbilisi-

Ceyhan (BTC) oil pipeline. The 1,768-kilometre pipeline transports oil from

the BP-operated ACG oilfield and gas condensate from the Shah Deniz

gas field in the Caspian Sea, along with other third-party oil, to the

eastern Mediterranean port of Ceyhan. The BTC pipeline has a capacity

of 1mmboe/d with average throughput in 2014 of 712mboe/d.

BP is technical operator of, and currently holds a 28.83% interest in, the

693-kilometre SCP. The pipeline takes gas from Azerbaijan through Georgia

to the Turkish border and has a capacity of 134mboe/d with average

throughput in 2014 of 111mboe/d. BP (as operator of Azerbaijan

International Operating Company) also operates the Western Export Route

Pipeline which transports ACG oil to the Black Sea coast of Georgia.

In Oman, BP currently has appraisal programmes and development

activities. In December 2013, BP and the Sultanate of Oman government

signed a gas sales agreement and an amended EPSA for the

development of the Khazzan field in block 61 with BP as operator.

• In February the Sultan of Oman issued a royal decree approving the

amended EPSA and the government acquired a 40% stake in block 61

through Makarim Gas Development LLC, a wholly owned subsidiary of

the state-owned Oman Oil Company Exploration & Production.

• In October we announced the award of two long-term drilling contracts

for the Oman Khazzan project in block 61. KCA Deutag was awarded

more than $400 million in contracts for the construction and operation

of five new build land rigs for Khazzan. Oman’s Abraj Energy Service

was awarded more than $330 million in contracts to supply three

drilling rigs for the full field development of the Khazzan project. Gas

production is expected to start in late 2017.

In Abu Dhabi, we had equity interests of 9.5% and 14.67% in onshore

and offshore concessions respectively in 2013. The Abu Dhabi onshore

concession expired in January 2014 with a consequent impact on

production of approximately 140mboe/d. BP participated in the tender

process for the new onshore concession.

We also have a 10% equity shareholding in the Abu Dhabi Gas

Liquefaction Company, which in 2014 supplied 5.9 million tonnes of LNG

(305.7bcfe regasified).

In India, BP has a 30% interest in four oil and gas PSAs operated by

Reliance Industries Limited (RIL), and is a partner with RIL in a 50:50 joint

operation for the sourcing and marketing of gas in India.

• During the year a number of activities continued to manage the

existing producing fields in the KG D6 block, with a focus on sustaining

production and extending the life of these fields. Activities included

well work-overs, side-tracks and new wells as well as progress on the

installation of additional compression capacity.

• In October the government of India announced new gas price

guidelines for domestic gas, effective 1 November 2014. The new

guidelines replace the earlier guidelines issued by the government in

January 2014.

• During the year we recorded an $810-million charge (comprising a

$415 million impairment charge and $395 million exploration write-off)

to write down the value ascribed to block KG D6 in India as part of the

acquisition of upstream interests from RIL in 2011. The charge arises

as a result of uncertainty in the future long-term gas price outlook,

following the introduction of a new formula for Indian gas prices,

although we do see the commencement of a transition to market-

based pricing as a positive step. We expect further clarity

on the new pricing policy and the premiums for future developments

to emerge in due course.

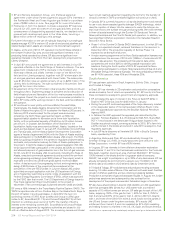

In Iraq, BP holds a 47.6% working interest and is the lead contractor in

the Rumaila technical service contract. Rumaila is one of the world’s

largest oil fields, comprising five producing reservoirs. BP’s total assets in

Iraq at 31 December 2014 were $1,606 million ($1,235 million current

and $371 million non-current).

In September we signed an amendment to the Rumaila contract terms,

which include, among other things, the increase of BP equity and a five-

year term extension until 2034. BP is also working with the government

of Iraq and North Oil Company on studies in support of the stabilization

and redevelopment of two producing reservoirs of the Kirkuk field.

Despite instability and sectarian violence in the north and west of the

country, BP operations are continuing in the south.

Australasia

We are active in Australia and Eastern Indonesia.

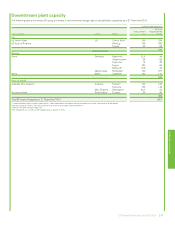

In Australia, BP is one of seven participants in the North West Shelf

(NWS) venture, which has been producing LNG, pipeline gas,

condensate, LPG and oil since the 1980s. Six partners (including BP) hold

an equal 16.67% interest in the gas infrastructure and an equal 15.78%

interest in the gas and condensate reserves, with a seventh partner

owning the remaining 5.32%. BP also has a 16.67% interest in some of

the NWS oil reserves and related infrastructure. The NWS venture is

currently the principal supplier to the domestic market in Western

Australia and one of the largest LNG export projects in Asia, with five

LNG trains in operation. BP’s net share of the capacity of NWS LNG

trains 1-5 is 2.7 million tonnes of LNG per annum.

BP also holds a 5.375% interest in the Jansz-lo field and 12.5% interests

in the Geryon, Orthrus and Maenad fields which are part of the Greater

Gorgon project. BP’s Jansz-Io interest is in the reserves and wells which

will provide the initial feed gas to the Gorgon LNG plant scheduled to

commence production late 2015.

BP holds a 70% interest in four deepwater offshore exploration blocks in

the Ceduna Sub Basin. BP, as operator, expects to drill four deepwater

wells beginning in 2016 in this frontier exploration basin located within

the Great Australian Bight off the coast of southern Australia.

• BP is also one of five participants in the Browse LNG venture (operated

by Woodside) and holds a 17% interest. Browse is currently in the pre-

FEED stage of an offshore floating LNG development and remains

subject to regulatory, joint operation and internal BP approvals.

• We accessed new acreage in the offshore Outer Canning basin in

Western Australia in September by farming in to two exploration

permits (BP 21%).

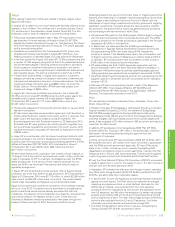

In Eastern Indonesia, BP operates the Tangguh LNG plant. Tangguh

(BP 37.16%), is located in Papua Barat. The asset comprises 14

producing wells, two offshore platforms, two pipelines and an LNG plant

with two production trains. It has a total capacity of 7.6 million tonnes of

LNG per annum. Tangguh supplies LNG to customers in Indonesia,

China, South Korea, Mexico and Japan through a combination of long,

medium and short-term contracts. Plans for a third train remain on track.

In August BP announced that the government of Indonesia, through the

Ministry of Environment, approved the Tangguh expansion project

integrated environment and social impact assessment and issued the

project (BP 37.16%) an environmental permit. This was followed by the

award of dual onshore FEED to two separate consortia, announced in

October. In addition, BP and the Tangguh partners signed a long-term

LNG sales agreement with PT PLN (Persero), Indonesia’s state-owned

electricity company, to supply up to 1.5 million tonnes of LNG each year

from 2015 to 2033. Supply will initially be provided from Tangguh’s

existing LNG trains. The agreement commits 40% of annual production

from train 3 to the domestic market.

BP has 100% interests in two deepwater PSAs: West Aru I and II and

32% interest in the Chevron-operated West Papua I and Ill PSAs. These

PSAs will be relinquished pending approval from the government of

Indonesia.

216 BP Annual Report and Form 20-F 2014