BP 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

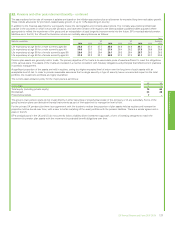

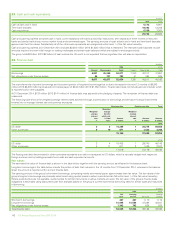

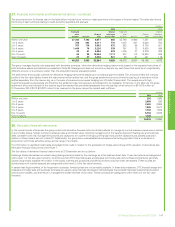

27. Financial instruments and financial risk factors – continued

The amounts shown for finance debt in the table below include future minimum lease payments with respect to finance leases. The table also shows

the timing of cash outflows relating to trade and other payables and accruals.

$ million

2014 2013

Trade and

other

payables Accruals

Finance

debt

Interest

relating to

finance debt

Trade and

other

payables Accruals

Finance

debt

Interest

relating to

finance debt

Within one year 37,342 7,102 6,877 892 43,790 8,960 7,381 885

1 to 2 years 708 493 6,311 776 1,007 207 6,630 752

2 to 3 years 757 119 5,652 672 822 66 6,720 621

3 to 4 years 1,446 76 5,226 578 761 73 5,828 498

4 to 5 years 23 41 6,056 479 1,405 37 5,279 388

5 to 10 years 24 95 19,504 1,111 207 113 15,933 809

Over 10 years 27 37 3,228 521 80 51 421 119

40,327 7,963 52,854 5,029 48,072 9,507 48,192 4,072

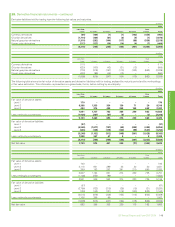

The group manages liquidity risk associated with derivative contracts, other than derivative hedging instruments, based on the expected maturitiesof

both derivative assets and liabilities as indicated in Note 28. Management does not currently anticipate any cash flows that could be of a significantly

different amount, or could occur earlier than the expected maturity analysis provided.

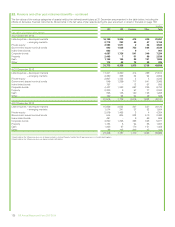

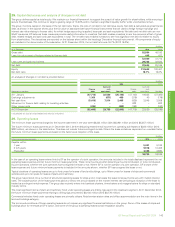

The table below shows cash outflows for derivative hedging instruments based upon contractual payment dates. The amounts reflect the maturity

profile of the fair value liability where the instruments will be settled net, and the gross settlement amount where the pay leg of a derivative will be

settled separately from the receive leg, as in the case of cross-currency swaps hedging non-US dollar finance debt. The swaps are with high

investment-grade counterparties and therefore the settlement-day risk exposure is considered to be negligible. Not shown in the table are the gross

settlement amounts (inflows) for the receive leg of derivatives that are settled separately from the pay leg, which amount to $14,615 million at

31 December 2014 (2013 $12,222 million) to be received on the same day as the related cash outflows.

$ million

2014 2013

Within one year 293 1,095

1 to 2 years 2,959 293

2 to 3 years 2,690 2,959

3 to 4 years 1,505 2,577

4 to 5 years 1,700 1,505

5 to 10 years 5,764 3,835

Over 10 years 1,325 –

16,236 12,264

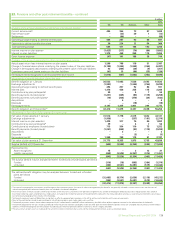

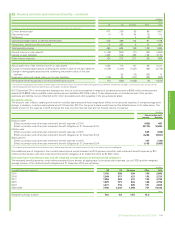

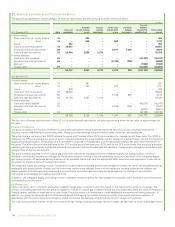

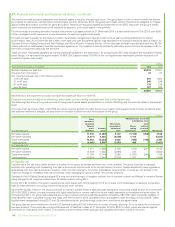

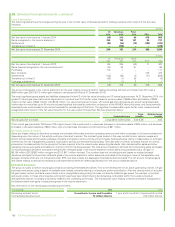

28. Derivative financial instruments

In the normal course of business the group enters into derivative financial instruments (derivatives) to manage its normal business exposures in relation

to commodity prices, foreign currency exchange rates and interest rates, including management of the balance between floating rate and fixed rate

debt, consistent with risk management policies and objectives. An outline of the group’s financial risks and the objectives and policies pursued in

relation to those risks is set out in Note 27. Additionally, the group has a well-established entrepreneurial trading operation that is undertaken in

conjunction with these activities using a similar range of contracts.

For information on significant estimates and judgements made in relation to the application of hedge accounting and the valuation of derivatives see

Derivative financial instruments within Note 1.

The fair values of derivative financial instruments at 31 December are set out below.

Exchange traded derivatives are valued using closing prices provided by the exchange as at the balance sheet date. These derivatives are categorized

within level 1 of the fair value hierarchy. Over-the-counter (OTC) financial swaps and physical commodity sale and purchase contracts are generally

valued using readily available information in the public markets and quotations provided by brokers and price index developers. These quotes are

corroborated with market data and are categorized within level 2 of the fair value hierarchy.

In certain less liquid markets, or for longer-term contracts, forward prices are not as readily available. In these circumstances, OTC financial swaps and

physical commodity sale and purchase contracts are valued using internally developed methodologies that consider historical relationships between

various commodities, and that result in management’s best estimate of fair value. These contracts are categorized within level 3 of the fair value

hierarchy.

Financial statements

BP Annual Report and Form 20-F 2014 147