BP 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

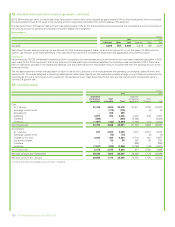

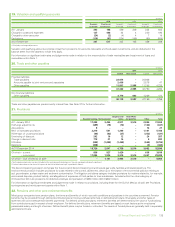

7. Taxation – continued

$ million

2014

excluding

impairments

2014

impacts of

impairments 2014 2013 2012

Profit (loss) before taxation 13,166 (8,216) 4,950 30,221 18,131

Tax charge (credit) on profit or loss 5,036 (4,089) 947 6,463 6,880

Effective tax rate 38% 50% 19% 21% 38%

% of profit before taxation

UK statutory corporation tax rate 21 21 21 23 24

Increase (decrease) resulting from

UK supplementary and overseas taxes at higher or lower ratesa17 34 (11) 412

Tax reported in equity-accounted entities (5) – (14) (2) (5)

Adjustments in respect of prior years (2) – (6) 11

Movement in deferred tax not recognized 4 (3) 17 22

Tax incentives for investment (4) – (10) (2) (2)

Gulf of Mexico oil spill non-deductible costs ––1–8

Permanent differences relating to disposalsb(1) – (1) (8) –

Foreign exchange 4–102 (1)

Items not deductible for tax purposes 4 (2) 12 12

Other –––– (3)

Effective tax rate 38 50 19 21 38

aFor 2014 excluding impairments, jurisdictions which contribute significantly to this item are Angola, with an applicable statutory tax rate of 50%, Trinidad, with an applicable statutory tax rate of 55%

and the US with an applicable federal tax rate of 35%. For 2014, impairment charges have generated losses on which tax credits arise, mainly in Norway and the UK North Sea, with applicable statutory

tax rates of 78% and 62% respectively. For 2013 and 2012, jurisdictions which contribute significantly are Angola, the UK and Trinidad with rates as disclosed above.

bFor 2013, this relates to the non-taxable gain on disposal of our investment in TNK-BP.

Legislation to reduce the UK supplementary charge tax rate applicable to profits arising in the North Sea is expected to be enacted in 2015. The

evaluation of the effect of this change for BP has not yet been completed.

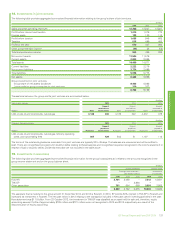

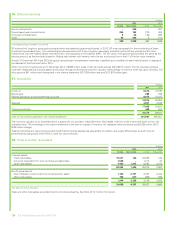

Deferred tax

$ million

Income statement Balance sheet

2014 2013 2012 2014 2013

Deferred tax liability

Depreciation (2,178) (474) (75) 29,062 31,551

Pension plan surpluses (272) (691) – –284

Other taxable temporary differences (1,278) (199) (2,239) 2,445 3,653

(3,728) (1,364) (2,314) 31,507 35,488

Deferred tax asset

Pension plan and other post-retirement benefit plan deficits 492 787 (33) (2,761) (2,026)

Decommissioning, environmental and other provisions 52 1,385 1,872 (11,237) (11,301)

Derivative financial instruments 166 30 (7) (575) (579)

Tax credits 589 (174) 1,802 (298) (888)

Loss carry forward (1,397) (343) (911) (3,848) (2,585)

Other deductible temporary differences 281 357 (445) (1,204) (1,655)

183 2,042 2,278 (19,923) (19,034)

Net deferred tax charge (credit) and net deferred tax liability (3,545) 678 (36) 11,584 16,454

Of which – deferred tax liabilities 13,893 17,439

– deferred tax assets 2,309 985

The recognition of deferred tax assets of $1,467 million (2013 $67 million), in entities which have suffered a loss in either the current or preceding

period, is supported by forecasts which indicate that sufficient future taxable profits will be available to utilize such assets.

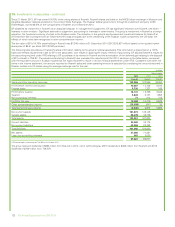

$ million

Analysis of movements during the year in the net deferred tax liability 2014 2013

At 1 January 16,454 14,369

Exchange adjustments 122 43

Charge (credit) for the year on profit (3,545) 678

Charge (credit) for the year in other comprehensive income (1,563) 1,397

Charge (credit) for the year in equity 36 (33)

Acquisitions 80 –

At 31 December 11,584 16,454

Financial statements

BP Annual Report and Form 20-F 2014 125