BP 2014 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2014 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

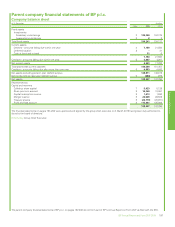

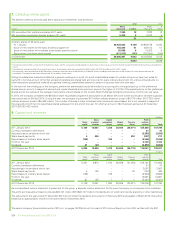

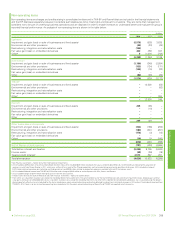

Notes on the financial statements

1. Accounting policies

Accounting standards

These accounts are prepared on a going concern basis and in accordance with the Companies Act 2006 and applicable UK accounting standards.

Accounting convention

The financial statements are prepared under the historical cost convention.

Foreign currency transactions

Functional currency is the currency of the primary economic environment in which an entity operates and is normally the currency in which the entity

primarily generates and expends cash. Transactions in foreign currencies are initially recorded in the functional currency by applying the rate of

exchange ruling at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated into the functional

currency at the rate of exchange ruling at the balance sheet date. Any resulting exchange differences are included in profit for the year. Exchange

adjustments arising when the opening net assets and the profits for the year retained by non-US dollar functional currency branches are translated into

US dollars are taken to a separate component of equity and reported in the statement of total recognized gains and losses.

Investments

Investments in subsidiaries and associated undertakings are recorded at cost. The company assesses investments for impairment whenever events or

changes in circumstances indicate that the carrying value of an investment may not be recoverable. If any such indication of impairment exists, the

company makes an estimate of its recoverable amount. Where the carrying amount of an investment exceeds its recoverable amount, the investment

is considered impaired and is written down to its recoverable amount.

Share-based payments

Equity-settled transactions

The cost of equity-settled transactions with employees of the company and other members of the group is measured by reference to the fair value at

the date at which equity instruments are granted and is recognized as an expense over the vesting period, which ends on the date on which the

employees become fully entitled to the award. A corresponding credit is recognized within equity. Fair value is determined by using an appropriate,

widely used, valuation model. In valuing equity-settled transactions, no account is taken of any vesting conditions, other than conditions linked tothe

price of the shares of the company (market conditions). Non-vesting conditions, such as the condition that employees contribute to a savings-related

plan, are taken into account in the grant-date fair value, and failure to meet a non-vesting condition, where this is within the control of the employee,is

treated as a cancellation.

Cash-settled transactions

The cost of cash-settled transactions recognized as an expense over the vesting period, measured by reference to the fair value of the corresponding

liability which is recognized on the balance sheet. The liability is remeasured at each balance sheet date until settlement, with changes in fair value

recognized in the income statement.

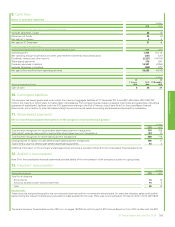

Pensions

The cost of providing benefits under the defined benefit plans is determined separately for each plan using the projected unit credit method, which

attributes entitlement to benefits to the current period (to determine current service cost) and to the current and prior periods (to determine the present

value of the defined benefit obligation). Past service costs and settlement costs are recognized immediately when the company becomes committed

to a change in pension plan design, or when a curtailment or settlement event occurs.

The interest element of the defined benefit cost represents the change in present value of scheme obligations resulting from the passage of time, and

is determined by applying the discount rate to the opening present value of the benefit obligation, taking into account material changes in the obligation

during the year. The expected return on plan assets is based on an assessment made at the beginning of the year of long-term market returns on plan

assets, adjusted for the effect on the fair value of plan assets of contributions received and benefits paid during the year. The difference between the

expected return on plan assets and the interest cost is recognized in the income statement as other finance income or expense.

Actuarial gains and losses are recognized in full within the statement of total recognized gains and losses in the period in which they occur.

The defined benefit pension plan surplus or deficit in the balance sheet comprises the total for each plan of the present value of the defined benefit

obligation (using a discount rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled

directly. Fair value is based on market price information and, in the case of quoted securities, is the published bid price. The surplus or deficit, net of

taxation thereon, is presented separately above the total for net assets on the face of the balance sheet. Deferred benefit pension plan surpluses are

only recognized to the extent they are recoverable.

The BP Pension Fund is operated in a way that does not allow the individual participating employing companies in the pension fund to identify their

share of the underlying assets and liabilities of the fund, and hence the company recognizes the full defined benefit pension plan surplus or deficit inits

balance sheet.

Deferred taxation

Deferred tax is recognized in respect of all timing differences that have originated but not reversed at the balance sheet date where transactions or

events have occurred at that date that will result in an obligation to pay more, or a right to pay less, tax in the future.

Deferred tax assets are recognized only to the extent that it is considered more likely than not that there will be suitable taxable profits from which the

underlying timing differences can be deducted.

Deferred tax is measured on an undiscounted basis at the tax rates that are expected to apply in the periods in which timing differences reverse, based

on tax rates and laws enacted or substantively enacted at the balance sheet date.

Use of estimates

The preparation of accounts in conformity with generally accepted accounting practice requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities at the date of the accounts and the reported amounts of revenues and expenses during the

reporting period. Actual outcomes could differ from these estimates.

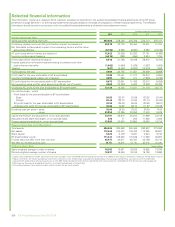

The parent company financial statements of BP p.l.c. on pages 197-206 do not form part of BP’s Annual Report on Form 20-F as filed with the SEC.

Financial statements

BP Annual Report and Form 20-F 2014 199