Audi 2007 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

226

pany assure that the interests of the members of the Board of Management are consistent

with those of the other stakeholders.

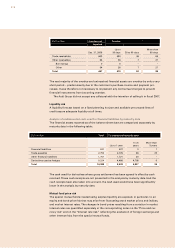

The remuneration paid to members of the Board of Management for the 2007 fiscal year

amounted to EUR 4,614 (4,531) thousand, of which variable components accounted for

EUR 2,309 (2,479) thousand. The variable component in the year before also included remu-

neration under stock options granted; the fair value at the time of granting amounted to

EUR 106 thousand. The fixed remuneration components for the members of the Board of

Management totaled EUR 2,305 (2,052) thousand in the 2007 fiscal year. Disclosure of the

remuneration paid to each individual member of the Board of Management, by name, pur-

suant to Section 314, Paragraph 1, No. 6a), Sentences 5 to 9, of the German Commercial

Code has not been effected, as the 2006 Annual General Meeting adopted a corresponding

resolution that is valid for a period of five years.

In addition to fixed payments in cash, there are varying levels of contributions in kind,

including, in particular, the use of company cars.

Each member of the Board of Management is paid a variable annual bonus. The variable

bonus comprises annually recurring components that are linked to the Company’s economic

success. It is largely based on the earnings achieved by the Company and its economic posi-

tion. There are no non-recurring variable components linked to business success in the

remuneration paid to members of the Board of Management.

Stock options serve as variable remuneration components providing a long-term incen-

tive. These options are based on the performance of Volkswagen ordinary shares. Since

Volkswagen AG’s stock option plan was not extended beyond 2006, no further convertible

bonds were issued in the 2007 fiscal year.

The structure of the stock option plan is essentially as follows: The basis for determining

the conversion price (base conversion price) of a tranche consists of the average Xetra clos-

ing prices of Volkswagen ordinary shares on the five trading days preceding each decision

to issue convertible bonds. Conversion may be effected for the first time following a qualify-

ing period of 24 months and thereafter up until a period of five years has elapsed from the

time the convertible bonds were issued. The conversion price is initially 110 percent of the

base conversion price, rising by five percentage points in each subsequent year. Members

of the Board of Management may exercise their conversion rights only three times a year,

during four-week exercise periods, each of which commences on a public reporting date of

Volkswagen AG. In the spirit of the German Corporate Governance Code, the stock option

plan is thus based on demanding, relevant comparison parameters. Further details are pre-

sented in the Agenda to the Annual General Meeting of Volkswagen AG on April 16, 2002,

which authorized the introduction of the stock option plan.

The structure of the stock option plan is designed to grant the members of the Board of

Management a remuneration component that is based on appreciation of the Company’s

trading price. It is thus intended to contribute toward increasing value creation and toward

enhancing the value of Volkswagen AG. Moreover, stock option plans are a widely used

instrument for recruiting and retaining board members.

Retrospective adjustment of the stock option plan’s performance targets or comparison

parameters is not permissible.

Inordinate proceeds from the stock options are not expected due to the linkage with the

trading price performance of Volkswagen ordinary shares and the restricted number of

options per tranche. In order to implement the recommendation of the German Corporate

Governance Code, the Supervisory Board is prepared to reach an agreement with the mem-

bers of the Board of Management on a cap in the event of exceptional, unforeseen devel-

opments.

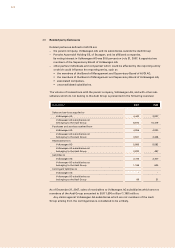

In the 2007 fiscal year, 1,500 stock options were exercised by members of the Board of

Management of AUDI AG. On December 31, 2007, the members of the Board of Management

were entitled to purchase a total of 14,500 ordinary shares of Volkswagen AG upon the con-