Audi 2007 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

218

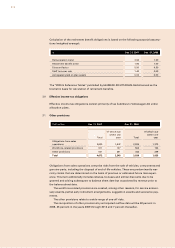

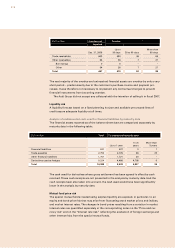

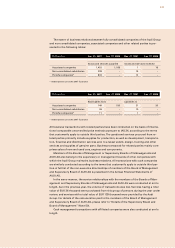

Had the value of the euro been 10 percent higher (lower) against all originated financial

instruments held in foreign currency on December 31, 2007, the other financial result and

the fair value of the financial instruments would have been EUR 26 million lower (higher)

(December 31, 2006: EUR 35 million lower (higher)).

Had the value of the euro been 10 percent higher (lower) against all securities invest-

ments held in foreign currency on December 31, 2007, there would have been no significant

effect on equity or profit.

Movements in the exchange rate against the underlying currencies for these transactions

affect the hedging reserve in equity and the fair value of these hedging transactions.

Had the value of the euro been 10 percent higher (lower) against the hedged foreign cur-

rencies on December 31, 2007, the hedging reserve in equity and the fair value of the hedg-

ing transactions overall would have been EUR 550 million higher or EUR 504 million lower

(December 31, 2006: EUR 549 million higher or EUR 350 million lower).

Raw materials risk

Raw materials risks are avoided or limited by entering into commodity futures or long-term

supply agreements. Hedging measures relate principally to the supply of the following raw

materials: Aluminum, lead, copper, palladium, platinum and rhodium.

Had the raw material prices been 10 percent higher (lower) on December 31, 2007, profit

would have been EUR 40 million higher (lower) (December 31, 2006: EUR 46 million higher

(lower)).

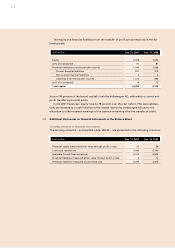

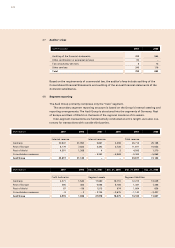

Interest rate risk

The interest rate risk stems from changes in market rates, above all for medium- and long-

term variable-rate receivables and liabilities.

The Audi Group is exposed to interest rate risks primarily in the euro zone, the United

Kingdom, the United States and Asia.

Interest rate risks are presented by means of sensitivity analyses pursuant to IFRS 7.

These analyses reveal the effects of changes in the market rates on interest payments, in-

terest income and expense, other earnings components, as well as equity, if applicable. The

interest rate sensitivity analyses are based on the following assumptions:

Had the market interest rate been 100 basis points higher (lower) on December 31, 2007,

equity would have been EUR 20 million lower or EUR 22 million higher (December 31, 2006:

EUR 18 million lower or EUR 20 million higher).

Had the market interest rate been 100 basis points higher (lower) on December 31, 2007,

profit would have been EUR 4 million higher (lower) (December 31, 2006: EUR 3 million

higher (lower)).

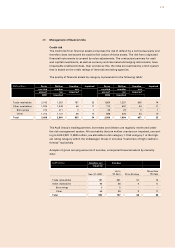

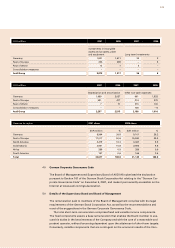

Credit risk

The credit risk from financial assets comprises the risk of default by a contractual party and

therefore does not exceed the positive fair values of these assets.

The assumption is made that the actual risk from originated financial instruments is cov-

ered by adequate reductions for impairment or uncollectability.

The credit risk from derivative financial instruments does not exceed the balance of posi-

tive market values in the event of default by a contractual party of Volkswagen AG or Audi

Group companies. The actual credit risk is negligible, as contracts are concluded only with

business partners of impeccable creditworthiness and trading limits are defined for each

business partner as a risk management measure.