Audi 2007 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

185

Operating expenses are recognized when the service is rendered or at the time they are

incurred economically.

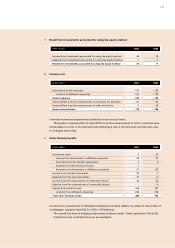

Intangible assets acquired for consideration are recognized at cost of purchase, taking into

account ancillary costs and cost reductions, and are amortized on a scheduled straight-line

basis over their useful life.

Concessions, rights and licenses relate to purchased computer software and subsidies

paid.

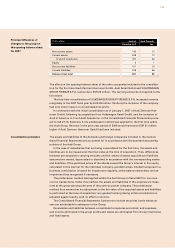

Research costs are treated as current expenses in accordance with IAS 38. The develop-

ment expenditure for products going into production is recognized as an intangible asset,

provided that production of these products is likely to bring economic benefit to the Audi

Group. If the conditions stated in IAS 38 for recognition as an intangible asset are not met,

the expenditure is expensed in the Income Statement in the year in which it occurs.

Development expenditure recognized as an intangible asset comprises all direct costs

and overheads directly attributable to the development process. Borrowing costs are not

capitalized. Amortization is performed on a straight-line basis from the start of production,

over the anticipated model life of the developed products.

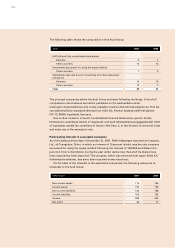

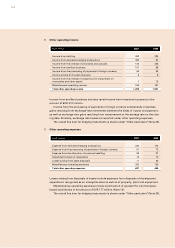

The amortization plan is based principally on the following useful lives:

Useful life

Concessions, industrial property rights and similar rights and values 3–15 years

of which software 3 years

Development expenditure recognized as an intangible asset 5–10 years

The amortization is allocated to the corresponding functional areas.

Goodwill created or acquired in a business combination is recognized and tested for im-

pairment regularly, as of the balance sheet date, pursuant to IAS 36. If necessary, an im-

pairment loss resulting from this test is recognized.

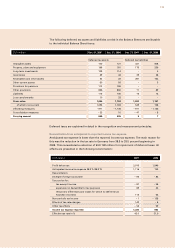

Property, plant and equipment are measured at cost, with straight-line depreciation being

applied according to the pro rata temporis method.

The costs of purchase include the purchase price, ancillary costs and cost reductions.

In the case of self-constructed fixed assets, the cost of construction includes both the di-

rectly attributable cost of materials and cost of labor as well as indirect materials and indi-

rect labor, which must be capitalized, together with pro rata depreciation. Interest on bor-

rowings is not included.

Intangible assets

Property, plant and

equipment