Audi 2007 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

204

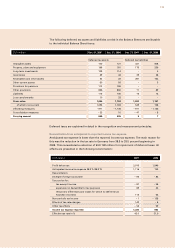

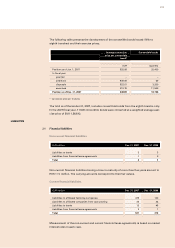

The share capital of AUDI AG totals EUR 110,080,000.00. Each share represents a mathemati-

cal share of EUR 2.56 of the issued capital. It is classified into 43,000,000 no-par bearer

shares.

The capital reserves contain premiums paid in connection with the issuance of shares of

the Company. In the year under review, capital reserves rose to EUR 911 million as a result

of a contribution in the amount of EUR 428 million by Volkswagen AG to the capital reserve

of AUDI AG.

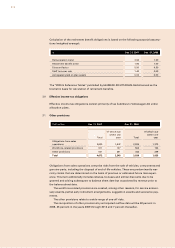

The opportunities and risks under foreign exchange contracts and currency option trans-

actions serving as hedges for future cash flows are deferred in the reserve for cash flow

hedges with no effect on the Income Statement. When the cash flow hedges become due,

the results from the settlement of the exchange-rate hedging contracts are reported in the

other operating income or expenses. Gains and losses from the measurement at fair value

of financial assets available for sale are recognized in the reserve for the market-price

measurement of securities. Upon disposal of the securities, share price gains and losses

realized are reported under the financial result.

Adjustments to actuarial assumptions on retirement benefit obligations are recognized

in the provisions for pensions and similar obligations.

Pursuant to IAS 28.39, foreign currency translation differences that do not affect income

from the accounting of FAW-Volkswagen Automotive Company, Ltd. using the equity

method were included in the reserve for equity method accounting after tax. The foreign

currency translation differences were reclassified from the currency exchange reserve to a

separate reserve item.

The minority interests in the Company’s equity relate to Volkswagen Group of America,

Inc., of Auburn Hills, U.S.A., and Volkswagen Canada Inc., of Ajax, Canada, which respec-

tively hold 100 percent of the shares of Audi of America, LLC and Audi Canada Inc. and to

which the earnings of the latter companies are attributable.

The balance of EUR 242 (487) million remaining after the transfer of profit to Volkswagen

AG is allocated to the other retained earnings.

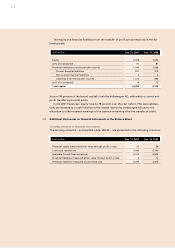

Stock option plan

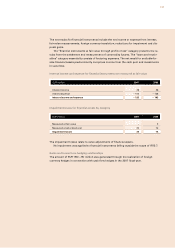

Under Volkswagen AG’s stock option plans, the members of the Board of Management and

selected senior managers of the Audi Group were granted the right to acquire stock options

for shares of Volkswagen AG by subscribing convertible bonds. In the 1999 to 2006 fiscal

years, a total of eight tranches of the stock option plan were issued. The stock option plan

was not extended for the period beyond 2006.

Each convertible bond is entitled to be converted into 10 ordinary shares. Conversion

may take place for the first time after a qualifying period of 24 months and then up until a

period of five years from the time of issuance of the convertible bond has elapsed. For de-

tails relating to the terms of subscription and exercise, please refer to the notes on equity in

the Annual Report of Volkswagen AG.

The convertible bonds are measured at fair value at the time of issue; in accordance with

the transitional provisions of IFRS 2, only convertible bonds granted after publication of the

draft standard on November 7, 2002, are affected. The fair value of the convertible bonds is

determined using a binomial option pricing model, and reported as personnel costs on a

pro rata basis over the 24-month qualifying period and under other changes in equity for

AUDI AG. Expenses of EUR 0.5 million were incurred in fiscal 2007. The corresponding ex-

pense for the previous fiscal year was EUR 0.6 million.