Audi 2007 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

216

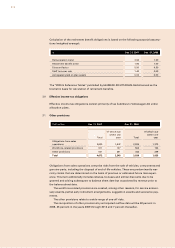

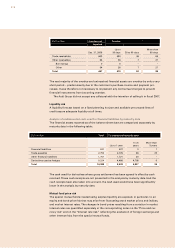

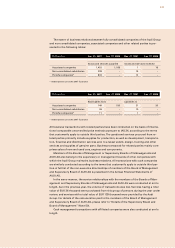

EUR million Overdue, not

impaired

Overdue

Dec. 31, 2006

Up to

30 days 30 to 90 days

More than

90 days

Trade receivables 603 493 46 64

Other receivables 54 26 7 21

Borrowings 0 0 – –

Other 54 26 7 21

Total 657 519 53 85

The vast majority of the overdue and unimpaired financial assets are overdue by only a very

short period – predominantly due to the customer’s purchase invoice and payment pro-

cesses. It was therefore not necessary to implement any contractual changes to prevent

financial instruments from becoming overdue.

The Audi Group did not accept any collateral with the intention of selling it in fiscal 2007.

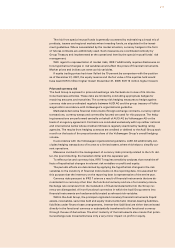

Liquidity risk

A liquidity forecast based on a fixed planning horizon and available yet unused lines of

credit assure adequate liquidity at all times.

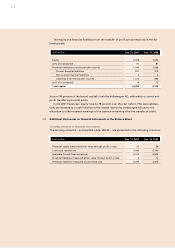

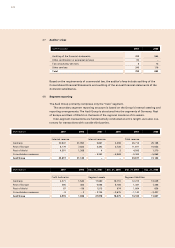

Analysis of undiscounted cash used for financial liabilities by maturity date

The financial assets reported as of the balance sheet date are categorized separately by

maturity date in the following table:

EUR million Total To contractual maturity date

Up to 1 year

1 to 5

years

More than

5 years

Financial liabilities 531 527 3 1

Trade payables 2,794 2,725 46 23

Other financial liabilities 1,751 1,721 30 –

Derivatives used as hedges 9,224 4,466 4,758 0

Total 14,300 9,439 4,837 24

The cash used for derivatives where gross settlement has been agreed is offset by cash

received. These cash receipts are not presented in the analysis by maturity date. Had the

cash receipts been also taken into account, the cash used would have been significantly

lower in the analysis by maturity date.

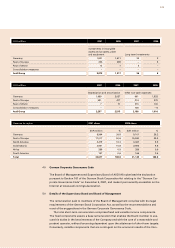

Mutual fund price risk

The special mutual funds created using surplus liquidity are exposed, in particular, to an

equity and bond price risk that may arise from fluctuating stock market prices and indices,

and market interest rates. The changes in bond prices resulting from a variation in market

interest rates are quantified separately in the corresponding notes on the “Price and cur-

rency risk” and on the “Interest rate risk,” reflecting the evaluation of foreign exchange and

other interest risks from the special mutual funds.