Audi 2007 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

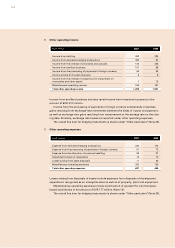

189

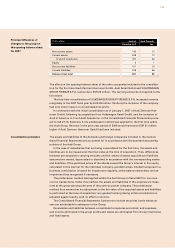

Derivative financial instruments that serve currency or price hedging purposes according

to business administration criteria but do not satisfy the strict criteria of IAS 39 are meas-

ured at fair value through profit or loss.

Other receivables and financial assets (except for derivatives) are recognized at amortized

cost. Provision is made for discernible non-recurring risks and general credit risks in the

form of corresponding value adjustments.

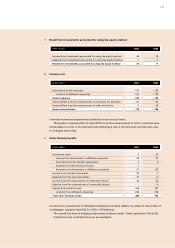

Pursuant to IAS 12, deferred tax is determined according to the balance sheet-focused liabil-

ity method. This method specifies that tax deferrals are to be created for all temporary dif-

ferences between the tax base of assets and liabilities and their carrying amounts in the

Consolidated Financial Statements (temporary concept). Deferred tax assets relating to

carryforward of unused tax losses must additionally be recognized.

Deferrals amounting to the anticipated tax burden or tax relief in subsequent fiscal years

are created on the basis of the anticipated tax rate at the time of realization. In accordance

with IAS 12, the tax consequences of distributions of profit are not recognized until the

resolution on the appropriation of profits is adopted.

Deferred tax assets include future tax relief resulting from temporary differences be-

tween the carrying amounts in the Consolidated Balance Sheet and the valuations in the

Balance Sheet for tax purposes. Deferred tax assets for carrying forward unused tax losses

that can be realized in the future and from tax relief must also be recognized.

Deferred tax assets and deferred tax liabilities are netted if the tax creditors and maturi-

ties are identical.

Pursuant to IAS 1.70, deferred tax is reported as non-current.

The carrying amount is reduced for deferred tax assets which are unlikely to be realized.

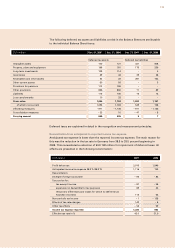

Raw materials and supplies are measured at the lower of average cost of acquisition or net

realizable value (net selling price). Other costs of purchase and purchase cost reductions are

taken into account as appropriate.

Work in progress and finished goods are valued at the lower of cost of conversion or net

realizable value. Cost of conversion includes direct materials and direct labor, as well as a

directly attributable portion of the necessary indirect materials and indirect labor, produc-

tion-related depreciation and expenses attributable to the products from the amortization of

production development expenditure recognized as an intangible asset. Distribution costs,

administrative expenses and interest on borrowings are not capitalized.

Merchandise is valued at the lower of cost of purchase or net realizable value.

Provision has been made for all discernible storage and inventory risks in the form of ap-

propriate write-downs. Individual downward valuation adjustments are made on all invento-

ries as soon as the probable proceeds from their sale or use are lower than the carrying

amounts of the inventories. The estimated selling price less the estimated costs incurred up

until their sale is regarded as the net realizable value of inventories.

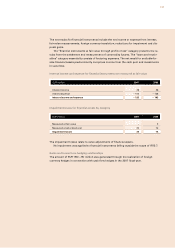

Securities held as current assets are measured at market value, i.e. at the trading price on

the balance sheet date.

Cash and cash equivalents are stated at their market value, which corresponds to the

nominal value.

Other receivables and

financial assets

Deferred tax

Inventories

Securities, cash and

cash equivalents