Audi 2007 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2007 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

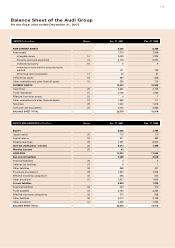

183

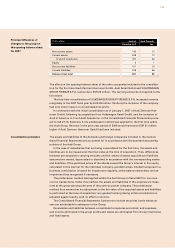

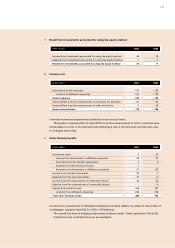

EUR million Audi of

America, LLC

Audi Canada

Inc.

Non-current assets 143 13

Current assets 538 72

of which inventories 357 46

Equity 4 1

Non-current liabilities 101 18

Current liabilities 576 66

Balance sheet total 681 85

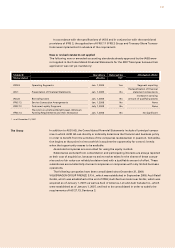

The effect on the opening balance sheet of the other companies included in the consolida-

tion for the first time (Audi Zentrum Hannover GmbH, Audi Retail GmbH and VOLKSWAGEN

GROUP FIRENZE S.P.A.) amounts to EUR 23 million. The carrying amounts correspond to the

fair values.

The first-time consolidation of VOLKSWAGEN GROUP FIRENZE S.P.A. increased revenue

marginally in the 2007 fiscal year by EUR 29 million. Similarly the inclusion of the company

had only minor impact on consolidated net profit.

In connection with the initial consolidation as of January 1, 2007 of Audi Zentrum Han-

nover GmbH, following its acquisition from Volkswagen Retail GmbH, and the inclusion of

Audi of America, LLC and Audi Canada Inc. in the Consolidated Financial Statements pursu-

ant to IAS 27.13, Sentence 2, the predecessor method was applied for the first time within

the Audi Group. Revenue in the prior-year period of 2006 would have been EUR 21 million

higher if Audi Zentrum Hannover GmbH had been included.

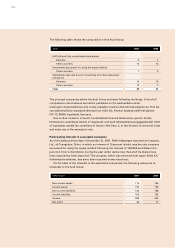

The assets and liabilities of the domestic and foreign companies included in the Consoli-

dated Financial Statements are accounted for in accordance with the standard accounting

policies of the Audi Group.

In the case of subsidiaries that are being consolidated for the first time, the assets and

liabilities are to be measured at their fair value at the time of acquisition. Thus, differences

between pre-acquisition carrying amounts and fair values of assets acquired and liabilities

assumed are carried, depreciated or dissolved in accordance with the corresponding assets

and liabilities. If the purchase prices of the shares exceed the Group’s interest in the equity

calculated in this manner for the individual company, goodwill arises. Goodwill acquired in a

business combination is tested for impairment regularly, at the balance sheet date, and an

impairment loss recognized if necessary.

The predecessor method was applied within the Audi Group in fiscal 2007 for common

control transactions. Under this method, the assets and liabilities of the acquiree are meas-

ured at the gross carrying amounts of the previous parent company. The predecessor

method thus means that no adjustment to the fair value of the acquired assets and liabilities

is performed at the time of acquisition; any goodwill arising during initial consolidation is

adjusted against equity, with no effect on income.

The Consolidated Financial Statements furthermore include securities funds whose as-

sets are attributable in substance to the Group.

Receivables and liabilities between consolidated companies are netted, and expenses

and income eliminated. Intra-group profits and losses are eliminated from Group inventories

and fixed assets.

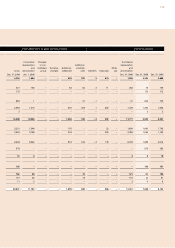

Principal influences of

changes to the group on

the opening balance sheet

for 2007

Consolidation principles