Asus 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

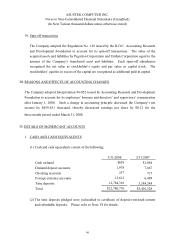

11

The Company adopted the R.O.C. SFAS No. 35 “Accounting for Asset Impairment”and

assesses indication for impairment for all its assets at balance sheet date. If impairment

indication exists, the Company then compares the carrying amount with the recoverable

amount of the assets or the cash-generating unit (“CGU”) and writes down the carrying

amount to the recoverable amount where applicable. Recoverable amount is defined as the

higher of net fair value and usable value.

For previously recognized losses, the Company assesses, at each balance sheet date, if any

indication exists that the impairment loss may no longer exist or may have decreased, the

Company recalculates the recoverable amount of the asset and reverses the impairment loss

to the extent that the carrying amount after the reversal would not exceed the original

carrying amount with no recognized impairment loss for the assets in prior years.

Impairment loss/(reversal) is classified as non-operating loss/(income).

16. Employees’bonuses and directors’and supervisors’remuneration

The Company adopted Interpretation 96-052 issued by Accounting Research and

Development Foundation to account for its employees’bonuses and directors’and

supervisors’remuneration as expenses rather than as distribution of retained earnings.

17. Earnings per share (EPS)

Primary EPS is calculated by dividing net income by the weight-average number of shares

outstanding during the period. In the event of capitalization of retained earnings or capital

surplus, the share number is retroactively adjusted for additional shares issued.

Diluted EPS is calculated by dividing net income by the weighted-average number of

common shares used in the primary EPS calculation plus the number of common shares that

would be issued assuming conversion of all potentially dilutive common shares outstanding.

Convertible bonds issued by the Company are potentially dilutive common shares. If a

dilutive effect does not exist, only primary EPS is disclosed; otherwise, diluted EPS is

disclosed in addition to primary EPS.

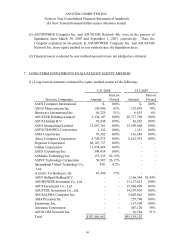

18. Preparation of consolidated financial statements and share swap

The Company adopted the R.O.C. SFAS No. 7 “Consolidated Financial Statements”for the

preparation of its consolidated financial statements and adopted SFAS No. 25 “Business

Combinations-Accounting Treatment under Purchase Method”to account for its share

swap transactions, respectively.