Asus 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

92

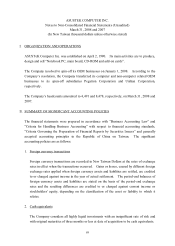

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

8

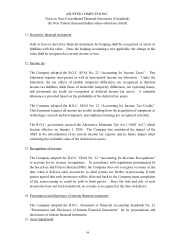

7. Property, plant and equipment and assets held for lease

(1) Property, plant and equipment and assets held for lease are stated at cost.

Expenditures for repairs and maintenance are charged against operating income.

Improvements that materially extend the useful life of the assets are capitalized.

(2) Depreciation is provided on the straight-line basis over the following useful lives:

Buildings and equipment 3 - 50 years

Machinery and equipment 5 - 6 years

Instrument equipment 3 - 8 years

Transportation equipment 5 years

Office equipment 5 years

Miscellaneous equipment 3 - 15 years

Warehousing equipment 8 years

(3) Additional depreciation is provided on the remaining salvage value of fully depreciated

property and equipment that are still in use over their remaining estimated economic

lives.

(4) Gain on disposal of assets is credited to current income, and loss on disposal of assets is

charged against current income.

8. Deferred charges

Deferred charges represent computer software, small tools, and office decorations, which

are amortized by the straight-line method over 2 to 5 years.

9. Convertible bonds payable

(1) For bonds issued prior to December 31, 2005, the issuance costs are recorded as

deferred charges and are amortized over the period from its issued date to maturity date.

For bonds issued after January 1, 2006, the issuance costs are allocated to the related

liability and equity components based on the proportion of the initially recognized

amounts.

(2) The difference between the redemption price and the face value of the bond shall be

amortized between the issued date and the last day of redemption period. The book

value method is adopted when an investor exercises his/her conversion rights.