Asus 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

41

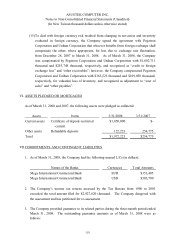

instruments:

The fair value of short-term financial instruments was estimated to approximate their

book value because of the short maturity. This method is used to evaluate cash and

cash equivalents, restricted time deposits, receivables, payables and short-term loans.

The fair value of financial assets at fair value through profit or loss-current and

available-for-sale financial assets-noncurrent was based on their quoted market price.

The fair value of accrued pension liabilities was based on the funding status of such

pension plan (projected benefit obligation less fair value of plan assets).

The fair value of refundable deposits and deposits received was based on their book

value because such received date or return date is uncertain.

The fair value of financial liabilities at fair value through profit or loss was based on the

value of call and put option. The fair value of bonds payable was discounted by its

expected future cash flow and the current interest rate.

The fair value of forward exchange contract is the amount the Company will receive or

pay if the Company terminates the contracts. Generally, such amount includes the

unrealized gain or loss. The fair value of forward exchange contract of the Company is

evaluated based on the quotation from financial institutions.

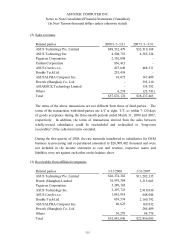

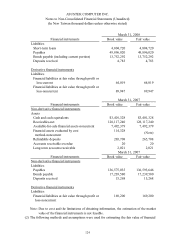

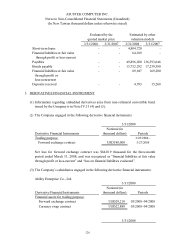

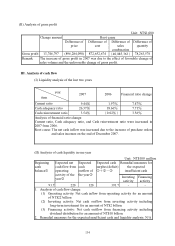

(3) Fair value of financial instruments based on the quoted market price and other valuation

models are as follows:

Evaluated by the

quoted market price

Estimated by other

valuation models

3/31/2008 3/31/2007 3/31/2008 3/31/2007

Financial Assets

Cash and cash equivalents $12,780,776 $3,401,328 $- $-

Financial assets at fair value

through profit or loss-current

15,719,325 - - -

Receivables-net - - 70,454,523 128,117,240

Restricted time deposits-current - - 1,850,000 -

Available-for-sale financial assets

-noncurrent

5,446,945 7,492,379 - -

Refundable deposits - - 124,828 265,708

Accounts receivable-overdue - - - 20

Long-term accounts receivable - - - 2,021

Financial Liabilities