Asus 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

134

134

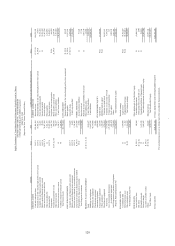

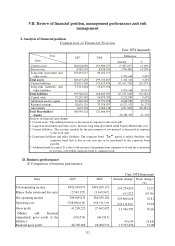

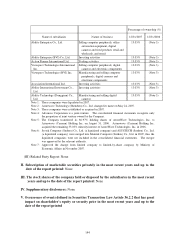

(II)Analysisofgrossprofit

Unit: NT$1,000

Rootcause

Changeamount

Differenceof

price

Differenceof

cost

Differenceof

sales

combination

Differenceof

quantity

Grossprofit 13,746,797 (896,284,090) 872,652,674 40,885,36378,263,576

Remark Theincreaseofgrossprofitin2007wasduetotheeffectoffavorablechangeo

f

salesvolumeandtheunfavorablechangeofgrossprofit.

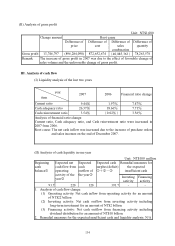

III.Analysisofcashflow

(I)Liquidityanalysisofthelasttwoyears

2007 2006 Financialratiochange

Currentratio 9.44 1.977.47

Cashadequacyratio 26.37 18.667.71

Cashreinvestmentratio 3.54 0.02 3.56

Analysisoffinancialratiochange:

Current ratio, Cash adequacy ratio, and Cash reinvestment ratio were increased in

2007from2006.

Rootcause:Thenetcashinflowwasincreasedduetotheincreaseofpurchaseorders

andsalesincomesontheendofDecember2007.

(II)Analysisofcashliquidityinoneyear

Unit: NT$100 million

Remedialmeasuresfor

theexpected

insufficientcash

Beginning

cash

balance

Expectednet

cashflowfrom

operating

activityofthe

year

Expected

cash

outflowof

theyear

Expectedcash

surplus(deficit)

Investing

activity

Financing

activity

91.7 220 120 191.7 - -

1. Analysisofcashflowchange:

(1) Operatingactivity:Netcashinflow fromoperatingactivityforanamount

ofNT$22billion

(2) Investing activity: Net cash outflow from investing activity including

long-terminvestmentforanamountofNT$2billion

(3) Financing activity: Net cash outflow from financing activity including

dividenddistributionforanamountofNT$10billion

2. Remedialmeasuresfortheexpectedinsufficientcashandliquidityanalysis:N/A

year

item