Asus 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

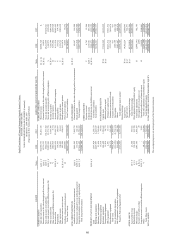

90

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

6

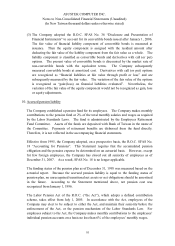

3. Financial assets and financial liabilities

The Company adopted the R.O.C. SFAS No. 34 “Accounting for Financial Instruments”

and the “Criteria Governing the Preparation of Financial Reports by Securities Issuers”,

where its financial assets are classified as either financial assets at fair value through profit

or loss, financial assets evaluated by cost method, or available-for-sale financial assets, as

appropriate. Financial liabilities are classified either as financial liabilities at fair value

through profit or loss, or financial liabilities at amortized cost.

The Company’s purchases and sales of financial assets and liabilities are recognized on the

trade date, or the date on which the Company commits to purchase or sell the asset and

liability. When financial assets and financial liabilities are recognized initially, they are

measured at fair value, plus, in the case of investments that are not at fair value through

profit or loss, directly attributable transaction costs.

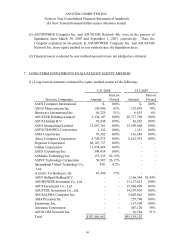

(1) Financial assets at fair value through profit or loss:

Financial assets are subsequently measured at fair value and changes in fair value are

recognized in profit and loss. Stocks of listed companies, convertible bonds and

close-end funds are measured at closing prices at balance sheet date. Open-end funds

are measured at the unit price of the net assets at the balance sheet date.

(2) Financial assets evaluated at cost:

Equity investments without reliable market prices, including unlisted and emerging

stocks, are measured at cost. If objective evidence of impairment exists, the Company

recognizes impairment loss, which shall not be reversed in subsequent periods.

(3) Available-for-sale financial assets:

Available-for-sale financial assets are non-derivative financial assets neither classified as

financial assets held for trading, nor held-to-maturity financial assets, loans and

receivables. Subsequent measurement is measured at fair value. The gain or loss

arising from the change in fair value, excluding impairment loss and exchange gain or

loss, is recognized as a separate component of stockholders’equity until such

investment is reclassified or disposed of, upon which the cumulative gain or loss

previously charged to stockholders’equity will be transferred to current gain or loss.

After initial recognition, the Company measured all financial liabilities at amortized cost,

except for financial liabilities at fair value through profit or loss which liabilities shall be

measured at fair value.