Asus 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

10

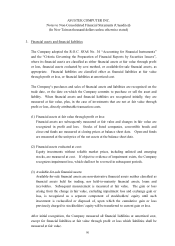

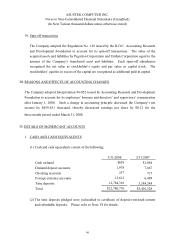

11. Derivative financial instrument

Gain or loss on derivative financial instrument for hedging shall be recognized as assets or

liabilities with fair value. Once the hedging accounting is not applicable, the change in fair

value shall be recognized as current income or loss.

12. Income tax

The Company adopted the R.O.C. SFAS No. 22 “Accounting for Income Taxes”. This

Statement requires inter-period as well as intra-period income tax allocation. Under the

Statement, the tax effects of taxable temporary differences are recognized as deferred

income tax liabilities while those of deductible temporary differences, net operating losses,

and investment tax credit are recognized as deferred income tax assets. A valuation

allowance is provided based on the probability of the deferred tax assets.

The Company adopted the R.O.C. SFAS No. 12 “Accounting for Income Tax Credits”.

This Statement requires all income tax credits resulting from the acquisition of equipment or

technology, research and development, and employee trainings are recognized currently.

The R.O.C. government enacted the Alternative Minimum Tax Act (“AMT Act”) which

became effective on January 1, 2006. The Company has considered the impact of the

AMT in the determination of its current income tax expense and its future impact when

estimating the realizable value of the deferred tax assets.

13. Recognition of revenue

The Company adopted the R.O.C. SFAS No. 32 “Accounting for Revenue Recognitions”

to account for its revenue recognitions. In accordance with regulations promulgated by

the Securities and Futures Bureau (SFB), the Company does not recognize revenues at the

time when it delivers such inventories to third parties for further re-processing if both

parties agreed that such inventories will be delivered back to the Company upon completion

of the re-processing or could be sold to third parties. Since the title and risk of such

inventories have not been transferred, no revenue is recognized at the time of delivery.

14. Presentation and disclosure of interim financial statements

The Company adopted the R.O.C. Statement of Financial Accounting Standards No. 23

‘‘Presentation and Disclosure of Interim Financial Statements’’ for its presentations and

disclosures of interim financial statements.

15. Asset impairment