Asus 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

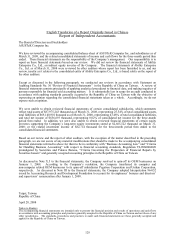

English Translation of a Report Originally Issued in Chinese

Report of Independent Accountants

The Board of Directors and Stockholders

ASUSTeK Computer Inc.

We have reviewed the accompanying consolidated balance sheet of ASUSTeK Computer Inc. and subsidiaries as of

March 31, 2008, and the related consolidated statements of income and cash flows for the three-month period then

ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to

report on these financial statements based on our review. We did not review the financial statements of Ability

Enterprise Co., Ltd., an indirect equity investee of the Company. The financial statements of Ability Enterprise

Co., Ltd. as of March 31, 2008 were reviewed by other auditors whose report has been furnished to us, and our

review, insofar as it relates to the consolidated entity of Ability Enterprise Co., Ltd., is based solely on the report of

the other auditors.

Except as discussed in the following paragraph, we conducted our reviews in accordance with Statement on

Auditing Standards No. 36 “Review of Financial Statements’’ in the Republic of China on Taiwan. A review of

financial statements consists principally of applying analytical procedures to financial data, and making inquiries of

persons responsible for financial and accounting matters. It is substantially less in scope for an audit conducted in

accordance with auditing standards generally accepted in the Republic of China on Taiwan with the objective of

expressing an opinion regarding the consolidated financial statements taken as a whole. Accordingly, we do not

express such an opinion.

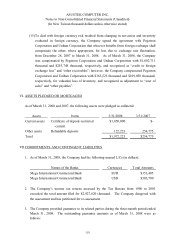

We were unable to obtain reviewed financial statements of certain consolidated subsidiaries, which statements

reflect total assets of $87,975,243 thousand as of March 31, 2008, representing 25.54% of total consolidated assets,

total liabilities of $69,140,901 thousand as of March 31, 2008, representing 43.48% of total consolidated liabilities,

and total net income of $636,693 thousand, representing 8.02% of consolidated net income for the three-month

period then ended. In addition, we were also unable to obtain reviewed financial statements of certain equity

investees supporting the Company’s long-term equity investments stated at $2,665,522 thousand on March 31,

2008; or the related investment income of $82,714 thousand for the three-month period then ended to the

consolidated financial statements.

Based on our review and the report of other auditors, with the exception of the matter described in the preceding

paragraph, we are not aware of any material modifications that should be made to the accompanying consolidated

financial statements referred to above for them to be in conformity with “Business Accounting Law”and “Criteria

for Handling Business Accounting”with respect to financial accounting standards, Regulation VI-0960064020

promulgated by Securities and Futures Bureau, “Criteria Governing the Preparation of Financial Reports by

Securities Issuers”and generally accepted accounting principles in the Republic of China on Taiwan.

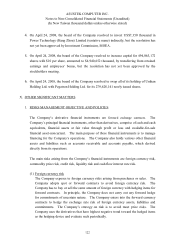

As discussed in Note X.5 to the financial statements, the Company resolved to spin-off its OEM businesses on

January 1, 2008. According to the Company’s resolution, the Company transferred its computer and

non-computer related OEM businesses to its spun-off subsidiaries Pegatron Corporation and Unihan Corporation,

respectively. As discussed in Note III to the financial statements, the Company adopted Interpretation 96-052

issued by Accounting Research and Development Foundation to account for its employees’bonuses and directors’

and supervisors’remuneration after January 1, 2008.

Taipei, Taiwan

Republic of China

April 28, 2008

Notice to Readers

The accompanying financial statements are intended only to present the financial position and results of operations and cash flows

in accordance with accounting principles and practices generally accepted in the Republic of China on Taiwan and not those of any

other jurisdictions. The standards, procedures and practices to audit such financial statements are those generally accepted and

applied in the Republic of China on Taiwan.