Asus 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

9

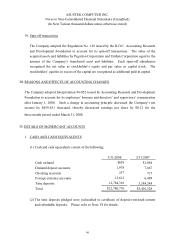

(3) The Company adopted the R.O.C. SFAS No. 36 “Disclosure and Presentation of

Financial Instruments”to account for its convertible bonds issued after January 1, 2006.

The fair value of financial liability component of convertible bonds is measured at

issuance. Then the equity component is assigned with the residual amount after

deducting the fair value of the liability component from the fair value as a whole. The

liability component is classified as convertible bonds and derivatives with call (or put)

options. The present value of convertible bonds is discounted by the market rate of

non-convertible bonds with the equivalent terms. The Company subsequently

measured convertible bonds at amortized cost. Derivatives with call (or put) options

are recognized as “financial liabilities at fair value through profit or loss”and are

subsequently measured by the fair value. The variation of the fair value of the options

is recognized as “gain/(loss) on financial liabilities evaluated”. Nevertheless, the

variation of the fair value of the equity component would not be recognized as gain, loss

or equity adjustments.

10. Accrued pension liability

The Company established a pension fund for its employees. The Company makes monthly

contributions to the pension fund at 2% of the total monthly salaries and wages as required

by the Labor Standards Laws. The fund is administrated by the Employees Retirement

Fund Committee. Assets of the funds are deposited with Bank of Taiwan in the name of

the Committee. Payments of retirement benefits are disbursed from the fund directly.

Therefore, it is not reflected in the accompanying financial statements.

Effective from 1995, the Company adopted, on a prospective basis, the R.O.C. SFAS No.

18 “Accounting for Pensions”. This Statement requires that the accumulated pension

obligation and the pension expense be determined on an actuarial basis. However, except

for few foreign employees, the Company has closed out all seniority of employees as of

December 31, 2007. As a result, SFAS No. 18 is no longer applicable.

The funding status of the pension plan as of December 31, 1995 was measured based on the

actuarial report. Because the accrued pension liability is equal to the funding status of

pension plan, no unrecognized transitional net assets or net obligations should be amortized

in the future. According to the Statement mentioned above, net pension cost was

recognized from January 1, 1996.

The Labor Pension Act of the R.O.C. (“the Act”), which adopts a defined contribution

scheme, takes effect from July 1, 2005. In accordance with the Act, employees of the

Company may elect to be subject to either the Act, and maintain their seniority before the

enforcement of the Act, or the pension mechanism of the Labor Standards Law. For

employees subject to the Act, the Company makes monthly contributions to the employees’

individual pension accounts on a basis no less than 6% of the employees’monthly wages.