Asus 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

22

E. Put option: Each bondholder has the right to put the convertible bonds at par

value ahead of time while the convertible bonds have been issued for more than 3 or

4 years.

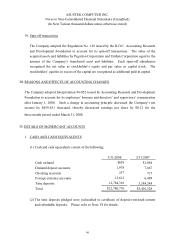

(5) The Company adopted the R.O.C. SFAS No. 34 “Accounting for Financial

Instruments”and No. 36 “Disclosure and Presentation of Financial Instruments”to

account for its convertible bonds issued after January 1, 2006. Such an adoption

resulted in an increase in interest expense due to amortization of discount on bonds

payable amounted to $59,388 thousand and $59,422 thousand, and gain/(loss) on

financial liabilities evaluated amounted to $1,199 thousand and ($21,600) thousand for

the three-month periods ended March 31, 2008 and 2007, respectively.

(6) Domestic non-collateralized convertible bonds that have been repurchased or converted

into the Company’s capital stock from the issuance date to March 31, 2008 and 2007

are as follows:

2008 2007

Converted shares Converted amount Converted shares Converted amount

1/1 72,614 shares $7,000 - shares -

1/1~3/31 - shares - - shares -

Total 72,614 shares $7,000 - shares -

14. CAPITAL STOCK

(1) On April 10, 1997, the Company’s stockholders resolved to increase capital for

$1,820,000 thousand by transferring from retained earnings. The meeting also

resolved to increase capital for cash for $210,000 thousand, or 21,000 thousand shares

at $10 per share, to facilitate the issuance of 21,000 thousand units of Global Depositary

Receipts (GDRs). The above increase in capital has been approved by the Ministry of

Economic Affairs. The GDRs were offered on May 30, 1997. Commencing three

months after completion of the offering, a holder of the GDRs may withdraw and hold

the shares represented by such GDRs or request depositary to sell or cause to be sold on

behalf of such holder of the shares represented by such GDRs.

(2) On January 1, 2007, the Company’s authorized capital amounted to $38,600,000

thousand and the outstanding capital amounted to $34,070,702 thousand, divided into

3,407,070,144 shares at $10 par value.

(3) On June 13, 2007, the stockholders resolved to increase capital for 240,604,146 shares

by transferring from retained earnings and emplyees’bonuses for $2,406,041 thousand.

The record date of the above increase in capital has been set on August 22, 2007.