Asus 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

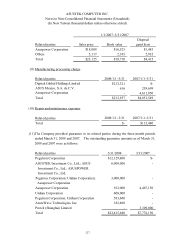

25

If there is any reversal of the debit balances subsequently, the amount of the reversal shall

be eligible for earnings distributions.

The Company estimated the employees’bonuses and directors’and supervisors’

remuneration in the first quarter of 2008 amounted to $557,396 thousand and $55,739

thousand, respectively, and recognized as operating expenses in this period. The deviation

of distribution between the estimation and the resolution of stockholders’meeting will be

recognized as profit or loss of the period.

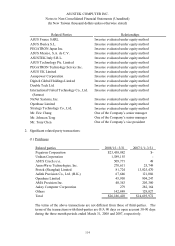

18. OPERATING COST/EXPENSES

The costs and expenses of personnel, depreciation and amortization for the three-month

periods ended March 31, 2008 and 2007 were as follows:

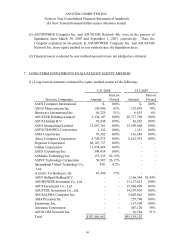

1/1/2008~3/31/2008 1/1/2007~3/31/2007

Nature Cost Expense Total Cost Expense Total

Personnel:

Salary -1,126,264 1,126,264 324,332 965,665 1,289,997

Labor and

health

insurance

-31,267 31,267 19,004 66,375 85,379

Pension -25,492 25,492 9,519 42,642 52,161

Other personnel -39,931 39,931 31,076 60,611 91,687

Depreciation -52,916 52,916 65,263 97,002 162,265

Amortization -161,356 161,356 5,066 156,729 161,795

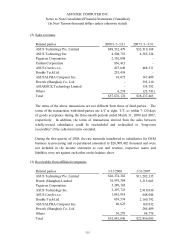

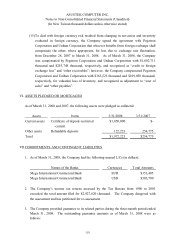

19. INCOME TAX AND DEFFERED INCOME TAX

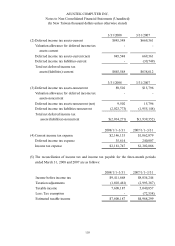

(1) Deferred income tax liabilities and assets as of March 31, 2008 and 2007:

3/31/2008 3/31/2007

Total deferred income tax liabilities $(2,023,773) $(1,985,897)

Total deferred income tax assets $855,050 $685,157

Temporary differences of deferred income tax

assets/(liabilities):

Unrealized gross profit $236,678 $193,902

Unrealized exchange loss/(gain) $141,158 $(30,553)

Allowance for doubtful accounts $2,744 $49,214

Employee welfare $15,159 $21,824

Unrealized loss on inventory valuation $362,636 $357,675

Depreciation and amortization $- $(222)

Foreign investment income of equity method $(2,023,773) $(1,955,122)

Unrealized accrued expense $95,727 $61,231

Deferred bond issuance costs $948 $1,311