Asus 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

23

(4) The Company’s board resolved, on July 24, 2007, to acquire shares of Ability

Enterprise Co., Ltd. by issuing new shares of the Company to Ability Investment Co.,

Ltd. The share swap date was on September 13, 2007 with a swap ratio of 1.71 shares

of Ability Enterprise Co., Ltd. for one share of the Company’s. Because of the above

transaction, the shares of the Company for the share swap increased for 29,824,561

shares. In addition, the Company’s capital and premium on capital stock increased by

$298,245 thousand and $2,400,281 thousand, respectively.

(5) In 2007, the holders of ECB I and domestic convertible bond converted the bonds to

50,787,481 and 72,614 common shares, and increased the issued and outstanding

capital for $507,875 thousand and $726 thousand, respectively.

(6) In the first quarter of 2008, the holders of ECB I converted the bonds to 3,529,551

common shares, and increased the issued and outstanding capital for $35,296 thousand.

(7) On March 31, 2008, the authorized capital of the Company was $42,500,000 thousand

($500,000 thousand were reserved for employee stock option) of which $37,318,885

thousand were issued and outstanding, divided into 3,731,888,497 shares at $10 par

value.

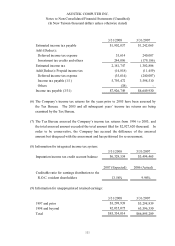

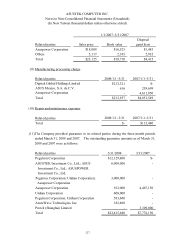

15. ADDITIONAL PAID-IN CAPITAL

(1) Additional paid-in capital consist of the following:

3/31/2008 3/31/2007

Premium on capital stock $20,213,812 $17,813,532

Premium on conversion of bonds 6,310,562 3,419,076

Treasury stock transactions 617 617

Stock option for issuance of convertible bonds 1,020,109 1,020,705

Effect of changes of the investee companies’

equity

2,053,487 805,876

Total $29,598,587 $23,059,806

(2) The R.O.C. Company Law states that additional paid-in capital, other than premium on

capital stock and donated capital, shall not be used to increase capital, nor can cash

dividends be declared from such additional paid-in capital.