Asus 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

16

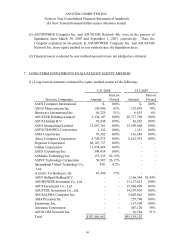

(2) The Company issued 29,824,561 new shares to Ability Investment Co., Ltd. in order to

acquire 51,000,000 common shares of Ability Enterprise Co., Ltd. The date for the

share swap was September 13, 2007. Please refer to Note IV.14.(4). After the share

swap, the Company obtained majority seats of the board of Ability Enterprise Co., Ltd.

As a result, the Company has control over the investee and accounted for this

investment under equity method.

(3) For the spin-off plan to restructure the Company’s business into own-brand and OEM,

the Company transferred certain of its long-term investments evaluated by equity

method (including Ability Enterprise Co., Ltd.) to its related parties on January 1, 2008.

Please refer to Note V.2.(14).

(4) The Company recognized its investment income in accordance with its equity investees’

current financial statements. The investment income for the three-month periods

ended March 31, 2008 and 2007 amounted to $2,622,891 thousand and $3,650,418

thousand, respectively. In addition, the Company’s long-term equity investments stated

at $90,836,895 thousand and $84,450,749 thousand on March 31, 2008 and 2007,

respectively; the related investment income for the three-month periods ended March 31,

2008 and 2007 amounted to $2,284,556 thousand and $2,983,140 thousand,

respectively, were based on unreviewed financial statements of such investees.

(5) According to the R.O.C. SFAS No. 7 “Consolidated Financial Statements”, those

investees where the Company maintains controlling interest have been included in the

consolidated financial statements for the three-month period ended March 31, 2008.

(6) Long-term investments evaluated by equity method are not pledged as collateral.

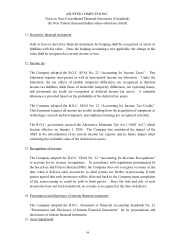

8. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consist of the following:

3/31/2008 3/31/2007

Land $1,019,424 $3,238,133

Buildings and equipment 2,429,897 4,243,647

Machinery and equipment 23,628 1,765,809

Warehousing equipment 16,518 34,932

Instrument equipment 684,680 1,356,643

Transportation equipment 16,014 38,772

Office equipment 4,091 17,315

Miscellaneous equipment 228,172 513,442

Total costs 4,422,424 11,208,693