Asus 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

21

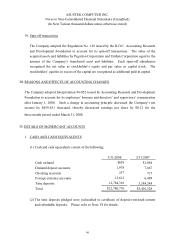

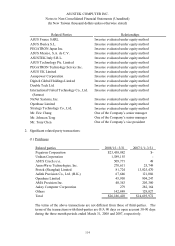

(3) ECB I that has been repurchased or converted into the Company’s capital stocks from

the issued date to March 31, 2008 and 2007, respectively, are as follows:

2008 2007

Converted shares Converted amount Converted shares Converted amount

1/1 96,390,052 shares USD 223,271,000 45,602,571 shares USD112,456,000

1/1~3/31 3,529,551 shares 7,535,000 5,012,766 shares 11,235,000

Total 99,919,603 shares USD 230,806,000 50,615,337 shares USD 123,691,000

(4) On November 7, 2006, the Company issued zero coupon rate domestic non-collateral

convertible bonds with a total face value of $12,000,000 thousand. According to the

R.O.C. SFAS No. 36 “Disclosure and Presentation of Financial Instruments”, the

Company separated the equity component from the liability component. The equity

component is recognized as “Additional paid-in capital-stock option”. The liability

component recognized as “Financial liabilities at fair value through profit or

loss-noncurrent,”contains a derivative attribute and is measured at fair value totaling

$89,947 thousand and $169,200 thousand for the three-month periods ended on March

31, 2008 and 2007, respectively. The liability component recognized as “Bonds

payable”, simply contains bond attribute and is measured by amortized cost, totaling

$11,137,818 thousand and $10,906,630 thousand on March 31, 2008 and 2007,

respectively.

The main issuance terms of the domestic non-collateral convertible bonds are as

follows:

A. Duration of issuance: from November 7, 2006 to November 7, 2011.

B. Conversion period: Each bondholder has the right to convert all or from time to

time any portion of its convertible bonds into common shares during the conversion

period (up to 31 days after the original issued date to 10 days before the maturity

date).

C. Conversion price and adjustment: The conversion price is NT$105.4 per common

share initially. The conversion price will be adjusted upon the occurrence of

increasing shares of common stock. Also, the conversion price will be reset in

accordance with certain conversion terms. The conversion price was subsequently

diluted to NT$96.4 per common share.

D. Call option: The Company could redeem the convertible bonds at its par value at

any time during the period from December 8, 2006 to September 28, 2011 under the

following conditions: (i) the closing price of the common shares on each of 30

consecutive trading days reaches or exceeds 50% of the conversion price, or (ii) the

outstanding balance is less than 10% of the original issuance.