Asus 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

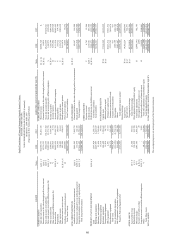

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

7

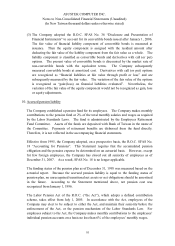

4. Allowance for doubtful accounts

Allowance for doubtful accounts is provided based on estimated collectibility of notes

receivable, accounts receivable, accounts receivable- affiliated companies, other receivables,

and accounts receivable-overdue.

5. Inventories

Inventories are valued at the lower of cost or market under the gross method. Cost is

determined by weighted-average method. Market price is determined by net realizable

value; except for raw materials which is determined by replacement cost.

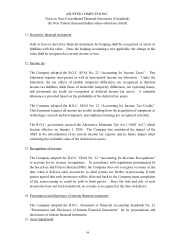

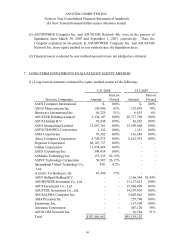

6. Long-term investments evaluated by equity method

(1) The difference between the acquisitions cost and the Company’s share of net assets of

the investee is analyzed and accounted for in the manner similar to acquisition cost

allocation as provided in SFAS No. 25 “Business Combinations-Accounting Treatment

under Purchase Method”under which goodwill is not amortized.

(2) When the Company has significant influence over an investee company, the Company

shall account for such investment under equity method.

(3) If certain long-term equity investments have incurred existing or probable loss, the

Company shall recognize investment loss in proportion to the percentage owned. The

investment loss shall first bring down the specific investment account to zero, then the

remaining loss, if any, will be recorded as “Other liabilities-credit to long-term

investments”.

(4) Unrealized profits incurred as a result of transactions between affiliated companies shall

be eliminated. Unrealized gross profits from downstream sales shall be debited to

“unrealized gross profits”and credited to “deferred credits”, whereas unrealized gross

profits from upstream and side-stream sales shall be debited to “investment loss”and

credited to “long-term investments”.

(5) When the Company issues new shares to acquire another company’s issued shares, the

carrying amount of the investment should be the fair market value of the Company’s

shares or the fair market value of another company’s issued shares, whichever is more

objective. If the carrying amount will be over or under the par value of the Company’s

shares, the difference should be credited to additional paid in capital or debited to

retained earnings, whereas the fair market value of the listed shares should base upon a

certain period before or after the announcement of the acquisition contract.