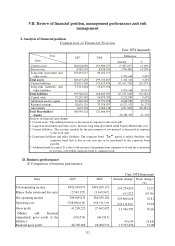

Asus 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

39

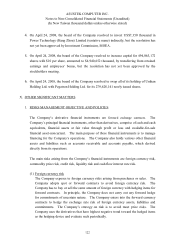

(2) Commodity price risk

The Company's exposure to price risk is minimal.

(3) Credit risk

The Company trades only with established and creditworthy third parties. It is the

Company's policy that all customers who wish to trade on credit terms are subject to

credit verification procedures. In addition, receivable balances are monitored on an

ongoing basis, which consequently minimizes the Company's exposure to bad debts.

With respect to credit risk arising from the other financial assets of the Company, which

comprise of cash and cash equivalents, available-for-sale financial assets and certain

derivative instruments, the Company's exposure to credit risk arising from the default of

counter-parties is limited to the carrying amount of these instruments.

Although the Company trades only with established third parties, it will request

collateral to be provided by third parties with less favorable financial positions.

(4) Liquidity risk

The Company's objective is to maintain a stable and flexible source of capital through

the use of financial instruments such as cash and cash equivalents, bank loans and bonds.

(5) Cash flow interest rate risk

There is no significant risk involved because the Company's short-term bank loans are

maturing within one year and the fluctuation of the floating rate is low.

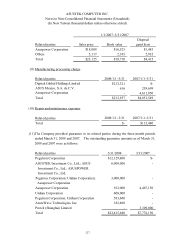

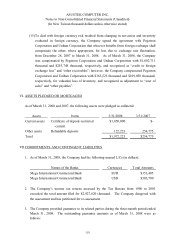

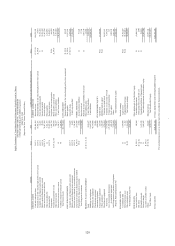

2. FINANCIAL INSTRUMENTS

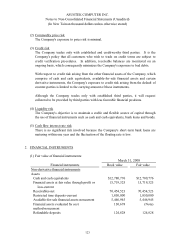

(1) Fair value of financial instruments:

March 31, 2008

Financial instruments Book value Fair value

Non-derivative financial instruments

Assets

Cash and cash equivalents $12,780,776 $12,780,776

Financial assets at fair value through profit or

loss-current

15,719,325 15,719,325

Receivables-net 70,454,523 70,454,523

Restricted time deposits-current 1,850,000 1,850,000

Available-for-sale financial assets-noncurrent 5,446,945 5,446,945

Financial assets evaluated by cost

method-noncurrent

130,678 (Note)

Refundable deposits 124,828 124,828