Asus 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

126

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

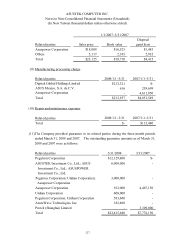

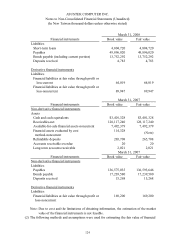

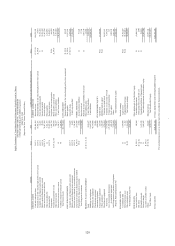

42

Evaluated by the

quoted market price

Estimated by other

valuation models

3/31/2008 3/31/2007 3/31/2008 3/31/2007

Short-term loans - - 4,804,720 -

Financial liabilities at fair value

through profit or loss-current

- - 64,019 -

Payables - - 49,896,020 136,593,646

Bonds payable - - 13,752,292 17,239,580

Financial liabilities at fair value

through profit or

loss-noncurrent

- - 89,947 169,200

Deposits received - - 4,783 15,268

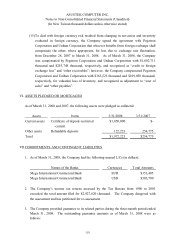

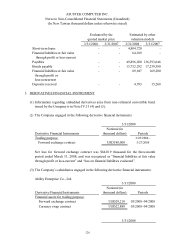

3. DERIVATIVES FINANCIAL INSTRUMENT

(1) Information regarding embedded derivatives arise from non-collateral convertible bond

issued by the Company is in Note IV.13 (4) and (5).

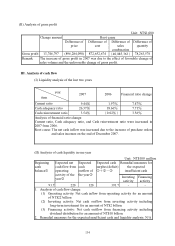

(2) The Company engaged in the following derivative financial instruments:

3/31/2008

Derivative Financial Instruments

Notional (in

thousand dollars) Periods

Trading purpose: 3/25/2008~

Forward exchange contract USD180,000 5/27/2008

Net loss for forward exchange contract was $64,019 thousand for the three-month

period ended March 31, 2008, and was recognized as “financial liabilities at fair value

through profit or loss-current”and “loss on financial liabilities evaluated”.

(3) The Company’s subsidiaries engaged in the following derivative financial instruments:

Ability Enterprise Co., Ltd.

3/31/2008

Derivative Financial Instruments

Notional (in

thousand dollars) Periods

Financial assets for trading purpose:

Forward exchange contract USD29,210 03/2008~04/2008

Currency swap contract USD22,880 03/2008~04/2008

3/31/2008