Asus 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177

|

|

124

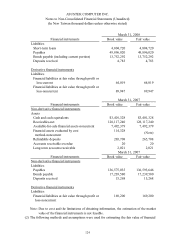

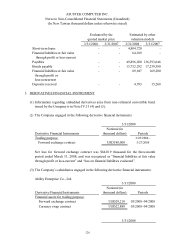

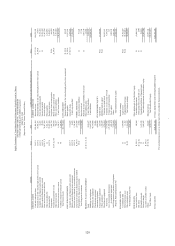

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

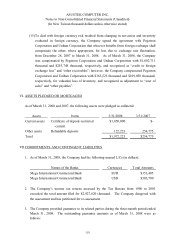

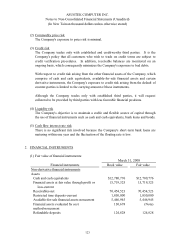

40

March 31, 2008

Financial instruments Book value Fair value

Liabilities

Short-term loans 4,804,720 4,804,720

Payables 49,896,020 49,896,020

Bonds payable (including current portion) 13,752,292 13,752,292

Deposits received 4,783 4,783

Derivative financial instruments

Liabilities

Financial liabilities

at fair value through profit or

loss-current 64,019 64,019

Financial liabilities

at fair value through profit or

loss-noncurrent 89,947 89,947

March 31, 2007

Financial instruments Book value Fair value

Non-derivative financial instruments

Assets

Cash and cash equivalents $3,401,328 $3,401,328

Receivables-net 128,117,240 128,117,240

Available-for-sale financial assets-noncurrent 7,492,379 7,492,379

Financial assets evaluated by cost

method-noncurrent

114,328 (Note)

Refundable deposits 265,708 265,708

Accounts receivable-overdue 20 20

Long-term accounts receivable 2,021 2,021

March 31, 2007

Financial instruments Book value Fair value

Non-derivative financial instruments

Liabilities

Payables 136,575,035 136,593,646

Bonds payable 17,239,580 17,239,580

Deposits received 15,268 15,268

Derivative financial instruments

Liabilities

Financial liabilities

at fair value through profit or

loss-noncurrent

169,200 169,200

Note: Due to cost and the limitations of obtaining information, the estimation of the market

value of the financial instruments is not feasible.

(2) The following methods and assumptions were used for estimating the fair value of financial