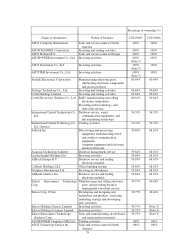

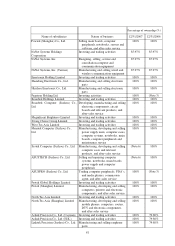

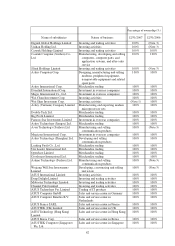

Asus 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

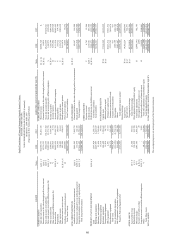

A

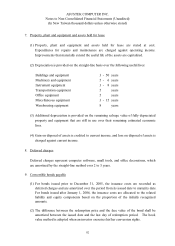

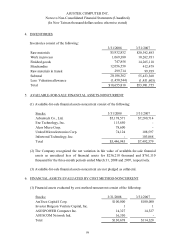

SUSTEK COMPUTER INC.

NON-CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(Expressed in New Taiwan Thousand Dollars)

2008 2007 2008 2007

CASH FLOWS FROM OPERATING ACTIVITIES: CASH FLOWS FROM INVESTING ACTIVITIES:

Net income $7,229,921 $6,731,358

In

crease

in certificate of deposit-restricted-current

(1,850,000)

-

Adjustments to reconcile net income to net cash Purchase of investments (310,494) (2,428,229)

provided by

/(used in)

operating activities:

Decrease in refundable deposits

129,512

1,643

Effects of changes in exchange rate for deposit in foreign currency (30,320) 78,141 Acquisition of property, plant and equipment (97,283) (128,604)

Depreciation 52,916 162,265

Proceeds from disposal of property, plant and equipment

919

37,692

Amortization 161,356 161,795

Increase in other assets

Purchase of

deferred charges

(102,287)

(150,688)

Depreciation from assets held for lease 706 1,014 Proceeds from disposal of deferred charges 157 419

Gain on disposal of

assets

(685)

(4,640)

In

crease in other assets

(77,392)

(33,849)

Loss on disposal of

assets

5,778

3,641

Cash transferred to spun-off subsidiaries

(2,000,000)

-

Property, plant and equipment transferred to other accounts

336

423

Net cash

used in

investing activities

(4,306,868)

(2,701,616)

Loss on obsolescence of property, plant and equipment

6,068

785

Investment income under equity method (2,622,891) (3,650,418) CASH FLOWS FROM FINANCING ACTIVITIES:

(Gain)/Loss on foreign exchange of bonds payable

(176,949)

96,600

Increase

in short-term loans

4,804,720

-

Amortization of discount and premium on bonds

58,670

57,792

Decrease

in deposits received

(11,920)

(100)

(Gain)/Loss on financial liabilities evaluated

(1,199)

21,600

Net cash provided by/(used in) financing activities

4,792,800

(100)

Amortization of deferred issuing cost of bonds 1,076 2,345

Changes in operating assets and liabilities: Effects of changes in exchange rate 30,320 (78,141)

(Increase)/Decrease in financial assets at fair value through profit or loss-current (8,462,156) 4,218,719

(Increase)/Decrease in notes and accounts receivable-net 53,019,166 (21,567,070) NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 3,606,557 (7,390,508)

(Increase)/Decrease in notes and accounts receivable-affiliated companies-net (8,133,928) (1,418,878)

CASH AND CASH EQUIVALENTS, BEGINNING OF THE

PERIOD

9,174,219

10,791,836

(Increase)/Decrease in other receivable

s-net

(719,057)

(1,412,741)

CASH AND CASH EQUIVALENTS, END OF THE

PERIOD

$12,780,776

$3,401,328

(Increase)/Decrease in other receivable

s-affiliated companies-net

(1,940,708)

11,688

(Increase)/Decrease in inventories-net 2,791,501 18,646,206

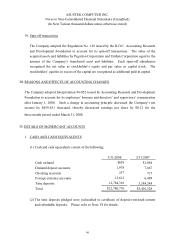

SUPPLEMENTAL DISCLOSURES OF CASH FLOWS

INFORMATION:

(Increase)/Decrease in prepayments 14,489 32,285

Cash paid during the

period

for:

(Increase)/Decrease in other current assets (2,957) (83,612)

(Increase)/Decrease in accounts receivable-overdue

-

4

Interest

$1,979

$4

(Increase)/Decrease in long-term accounts receivable-affiliated companies 4,998 444

(Increase)/Decrease in deferred income tax assets-current

(180,026)

(180,592)

Income tax

$14,856

$11,468

Increase/(Decrease)

in deferred income tax liabilities-noncurrent

215,640

420,600

Increase/

(

Decrease

)

in financial

liabilities

at fair value through profit or loss-current

64,019

-

Increase/(Decrease) in notes and accounts payable (31,351,191) (1,758,022) INVESTING AND FINANCING ACTIVITIES PARTIALLY AFFECTED CASH FLOWS:

Increase/(Decrease) in accounts payable-affiliated companies 605,303 (7,652,140) Items affected by spin-off of subsidiaries

Increase/(Decrease) in income tax payable

2,131,277

1,091,150

Non-cash assets transferred to spun-off subsidiaries

$111,851,499

$-

Increase/(Decrease) in accrued expenses (2,765,335) (541,602) Liabilities transferred to spun-off subsidiaries (31,851,499) -

Increase/(Decrease) in

accrued expenses-affiliated companies

(6,160,372)

1,711,496

Acquisition of long-term equity investments from spun-off subsidiaries

(82,000,000)

-

Increase/(Decrease) in other payables

(260,841)

(94,887)

Cash transferred to spun-off subsidiaries

($2,000,000)

$-

Increase/(Decrease) in receipts in advance (78,465) 437,888

Increase/(Decrease) in other current liabilities (17,218) (15,253) INVESTING AND FINANCING ACTIVITIES NOT AFFECTING CASH FLOWS:

(Increase)/Decrease in compensating interest receivable

(6,960)

(15,857)

Increase/(Decrease) in deferred credits

(361,657)

(103,178)

Bonds payable converted to capital stock

$233,617

$358,475

Net cash provided by/(used in) operating activities

3,090,305

(4,610,651)

Bonds payable-current portion

$2,614,474

$-

English Translations of Financial Statements Originally Issued in Chinese

FOR THE THREE-MONTH PERIODS ENDED MARCH 31, 2008 AND 2007

The accompanying notes are an integral part of the financial statements.

4