Asus 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

24

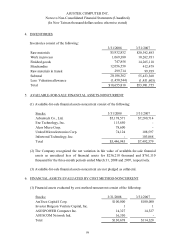

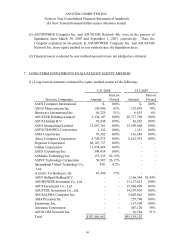

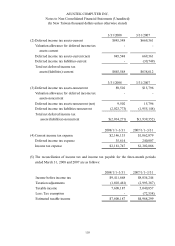

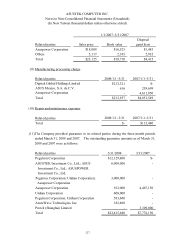

16. LEGAL RESERVE

The R.O.C. Company Law stipulates that, after paying all taxes, companies must retain at

least 10% of their annual earnings, as defined in the Law, until such retention equals the

amount of capital stock. This retention can be used to make up prior years’losses. Once

the legal reserve equals one-half of capital stock, 50% of the reserve may be transferred to

common stock.

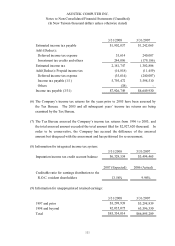

17. DISTRIBUTION OF EARNINGS

As provided by the Company’s Articles of Incorporation, annual net income after making

up prior years' losses, if any, should be distributed as follows: (1) To appropriate 10% as

legal reserve, with its remainder, (2) To appropriate 10% of capital stock as interest, with

its remainder, (3) To appropriate 10% as employees’bonus, and (4) To appropriate 1% as

directors’and supervisors’bonus. (5) After the distribution of earnings, the remained

earnings, if any, may be appropriated according to a resolution adopted in a stockholders’

meeting. (6) The cash dividends should be no less than 10% of the total amount of capital

interest, cash dividends and stock dividends.

Information for the distribution of annual net income of 2007 and 2006:

New Taiwan dollars

Items 2007 2006

Stockholders’bonus-cash (in dollar per share) $2.50 $1.50

Stockholders’bonus-stock (in dollar per share) 1.00 0.50

Employee bonus-cash 912,030 688,712

Employee bonus-stock 1,200,000 700,000

Directors and supervisors’remuneration 211,203 138,871

As required by the government, if the Company’s stockholders’equity has any debit

balances such as unrealized loss for long-term equity investments and translation

adjustments, an equal amount of such shall be appropriated as a special reserve before any

distribution of earnings. The appropriation shall comply with the following rules:

(1) For debit balances incurred during the year, the amount of the special reserve shall not

exceed the summation of current income after tax and accumulated earnings.

(2) For debit balances incurred in prior years, the amount of the special reserve set aside

shall not exceed the accumulated earnings minus the appropriated special reserve as per

(1) above.