Asus 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

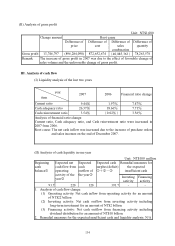

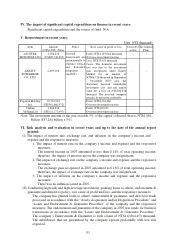

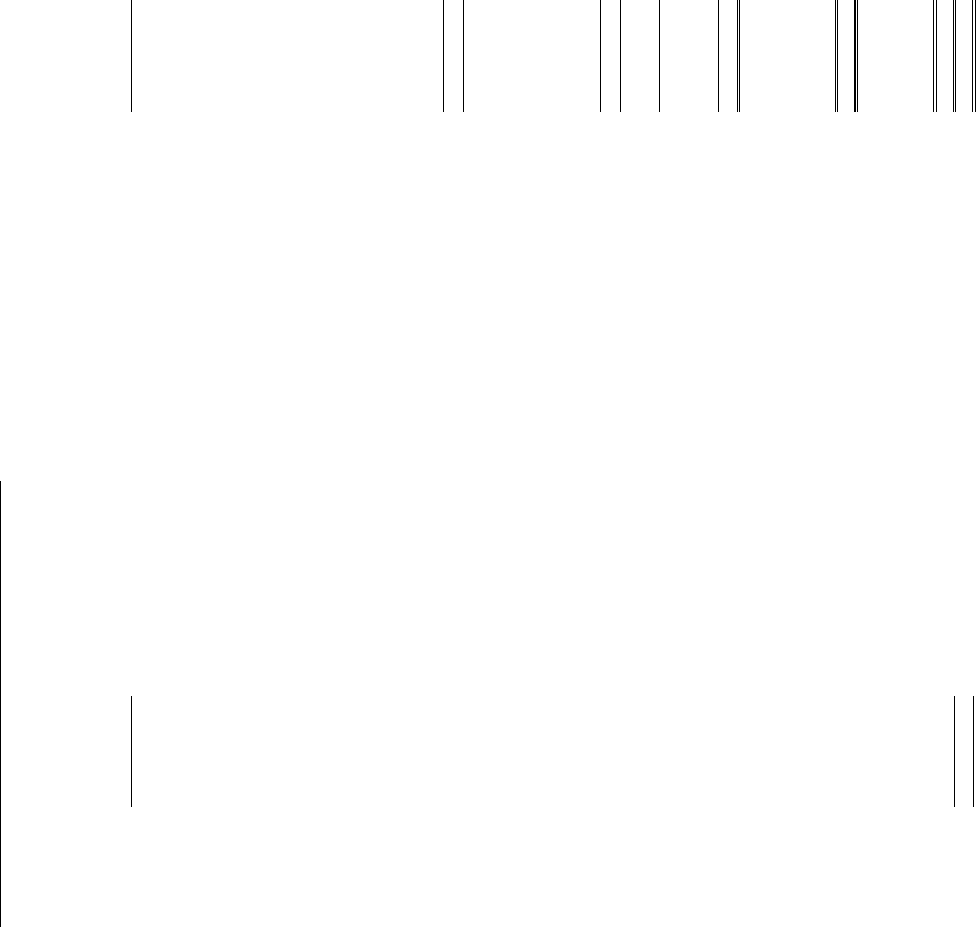

131

2008 2008

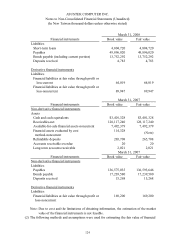

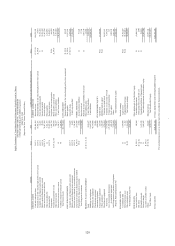

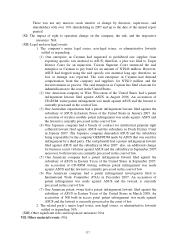

CASH FLOWS FROM OPERATING ACTIVITIES:

CASH FLOWS FROM INVESTING ACTIVITIES:

Net income $7,229,921 Increase in certificate of deposit-restricted-current (2,146,752)

Adjustments to reconcile net income to net cash Purchases of investments (239,374)

provided by operating activities: Proceeds from disposal of investments 499,938

Minority interest income 712,829 Prepayments for long-term investments (67,500)

Effect of change in exchange rate from foreign consolidated subsidiaries (2,362,521) Increase in refundable deposits (255,086)

Depreciation 1,800,651 Purchase of property, plant and equipment (2,487,364)

Amortization 441,815

Proceeds from disposal of property, plant and equipment

32,395

Depreciation and loss on market price decline of idle assets and assets held for lease 4,506 Purchase of deferred charges (538,793)

Impairment loss 704 Proceeds from disposal of deferred charges 157

Investment income under equity method (106,503) Proceeds from disposal of idle assets 316

Amortization of investment premium arising from acquisition 82,049 Decrease in other assets-others 23,447

Gain on disposal of investments 24,825 Increase in other intangible assets (6,068)

Gain on disposal of assets (2,493) Increase in consolidated debit (7,385)

Loss on disposal of assets 13,304 Purchase of minority interests (19,415)

Loss on obsolescence of property, plant and equipment 7,638 Increase in cash from acquisition of subsidiaries 9,435

Property, plant and equipment transferred to other accounts 23,453 Net cash used in investing activities (5,202,049)

Deferred charges transferred to other accounts 20,030

Idle assets transferred to other accounts (644) CASH FLOWS FROM FINANCING ACTIVITIES:

Amortization of deferred issuing cost of bonds 1,076 Increase in short-term loans 3,733,841

Gain on foreign exchange of bonds payable (176,949) Decrease in deposits received (149,470)

Amortization of discount and premium on bonds 58,670 Redemption of long-term loans (164,299)

Gain on financial liabilities evaluated (1,199) Increase in subsidiary's treasury stocks purchased by subsidiary (182,705)

Changes in operating assets and liabilities: Increase in subsidiaries' capital from minority shareholders 239,975

(Increase)/Decrease in financial assets at fair value through profit or loss-current (6,675,301) Net cash provided by financing activities 3,477,342

(Increase)/Decrease in notes and accounts receivable-net 52,784,522

(Increase)/Decrease in other receivables-net (2,163,440) Effect of changes of certain subsidiaries (262,830)

(Increase)/Decrease in inventories-net 5,839,994

(Increase)/Decrease in prepayments 136,496 NET INCREASE IN CASH AND CASH EQUIVALENTS 7,824,586

(Increase)/Decrease in other current assets 912,343 CASH AND CASH EQUIVALENTS, BEGINNING OF THE PERIOD 43,585,783

(Increase)/Decrease in deferred income tax assets-current (155,153) CASH AND CASH EQUIVALENTS, END OF THE PERIOD $51,410,369

(Increase)/Decrease in compensating interest receivable (6,960)

Increase/(Decrease) in financial liabilities at fair value through profit or loss-current 75,931

Increase/(Decrease) in notes and accounts payable (48,095,470) SUPPLEMENTAL DISCLOSURES OF CASH FLOWS INFORMATION:

Increase/(Decrease) in income tax payable 3,155,540 Cash paid during the period for:

Increase/(Decrease) in accrued expenses (4,311,722) Interest $56,711

Increase/(Decrease) in other payables (1,838,755) Income tax $331,705

Increase/(Decrease) in receipts in advance 466,591

Increase/(Decrease) in other current liabilities 1,677,888

Increase/(Decrease) in accrued pension liabilities 15,057

INVESTING AND FINANCING ACTIVITIES NOT AFFECTING CASH FLOWS

Increase/(Decrease) in deferred income tax liabilities-noncurrent 240,754 Bonds payable converted to capital stock $233,617

Increase/(Decrease) in other liabilities-others (17,354) Long-term loans-current portion $666,470

Net cash provided by operating activities 9,812,123 Bonds payable-current portion $2,614,474

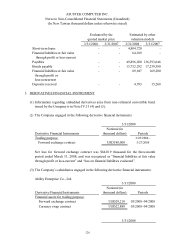

English Translations of Financial Statements Originally Issued in Chinese

FOR THE THREE-MONTH PERIOD ENDED MARCH 31, 2008

The accompanying notes are an integral part of the consolidated financial statements.

ASUSTEK COMPUTER INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

(Expressed in New Taiwan Thousand Dollars)

4