Asus 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

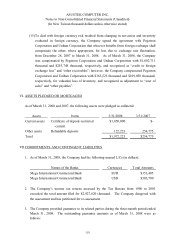

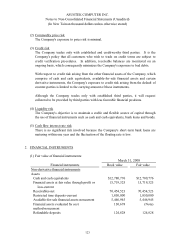

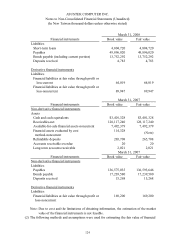

ASUSTEK COMPUTER INC.

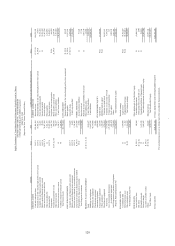

Notes to Non-Consolidated Financial Statements (Unaudited)

(In New Taiwan thousand dollars unless otherwise stated)

38

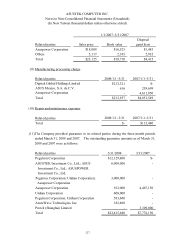

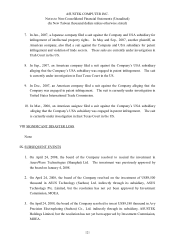

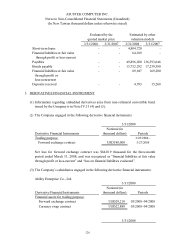

4. On April 24, 2008, the board of the Company resolved to invest US$7,350 thousand in

Power Technology (Hang Zhou) Limited (tentative name) indirectly, but the resolution has

not yet been approved by Investment Commission, MOEA.

5. On April 24, 2008, the board of the Company resolved to increase capital for 494,065,172

shares with $10 per share, amounted to $4,940,652 thousand, by transferring from retained

earnings and employees’bonus, but the resolution has not yet been approved by the

stockholders meeting.

6. On April 24, 2008, the board of the Company resolved to swap all of its holding of Unihan

Holding Ltd. with Pegatron Holding Ltd. for its 279,628,141 newly issued shares.

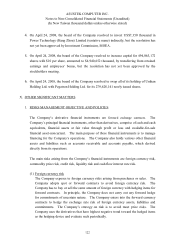

X. OTHER SIGNIFICANT MATTERS

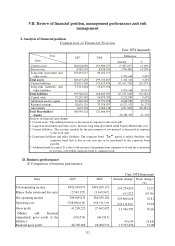

1. RISKS MANAGEMENT OBJECTIVE AND POLICIES

The Company’s derivative financial instruments are forward exchange contracts. The

Company’s principal financial instruments, other than derivatives, comprise of cash and cash

equivalents, financial assets at fair value through profit or loss and available-for-sale

financial asset-noncurrent. The main purpose of these financial instruments is to manage

financing for the Company’s operations. The Company also holds various other financial

assets and liabilities such as accounts receivable and accounts payable, which derived

directly from its operations.

The main risks arising from the Company’s financial instruments are foreign currency risk,

commodity price risk, credit risk, liquidity risk and cash flow interest rate risk.

(1) Foreign currency risk

The Company exposes to foreign currency risks arising from purchases or sales. The

Company adopts spot or forward contracts to avoid foreign currency risk. The

Company has to buy or sell the same amount of foreign currency with hedging items for

forward contracts. In principle, the Company does not carry out any forward hedge

for commitments of uncertain nature. The Company enters into the forward currency

contracts to hedge the exchange rate risk of foreign currency assets, liabilities and

commitments. The Company’s strategy on risk is to avoid most price risks. The

Company uses the derivatives that have highest negative trend toward the hedged items

as the hedging device and evaluate such periodically.