Asus 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

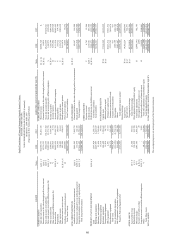

89

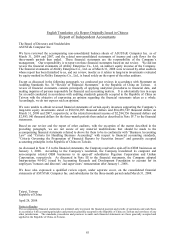

ASUSTEK COMPUTER INC.

Notes to Non-Consolidated Financial Statements (Unaudited)

March 31, 2008 and 2007

(In New Taiwan thousand dollars unless otherwise stated)

5

I. ORGANIZATION AND OPERATIONS

ASUSTeK Computer Inc. was established on April 2, 1990. Its main activities are to produce,

design and sell “Notebook PC, main board, CD-ROM and add-on cards”.

The Company resolved to spin-off its OEM businesses on January 1, 2008. According to the

Company’s resolution, the Company transferred its computer and non-computer related OEM

businesses to its spun-off subsidiaries Pegatron Corporation and Unihan Corporation,

respectively.

The Company’s headcounts amounted to 4,491 and 8,478, respectively, on March 31, 2008 and

2007.

II. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The financial statements were prepared in accordance with “Business Accounting Law”and

“Criteria for Handling Business Accounting”with respect to financial accounting standards,

“Criteria Governing the Preparation of Financial Reports by Securities Issuers”and generally

accepted accounting principles in the Republic of China on Taiwan. The significant

accounting policies are as follows:

1. Foreign currency transactions

Foreign currency transactions are recorded in New Taiwan Dollars at the rates of exchange

rates in effect when the transactions occurred. Gains or losses, caused by different foreign

exchange rates applied when foreign currency assets and liabilities are settled, are credited

to or charged against income in the year of actual settlement. The period-end balances of

foreign currency assets and liabilities are stated on the basis of the period-end exchange

rates and the resulting differences are credited to or charged against current income or

stockholders' equity, depending on the classification of the asset or liability to which it

relates.

2. Cash equivalents

The Company considers all highly liquid investments with an insignificant rate of risk and

with original maturities of three months or less at date of acquisition to be cash equivalents.