Air New Zealand 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results

46

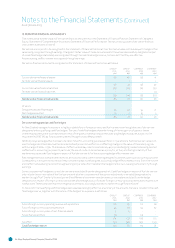

. PENSION OBLIGATIONS CONTINUED

GROUP AND COMPANY

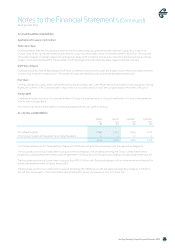

Major categories of plan assets:

Fixed interest unit fund 55% 54%

Property unit fund - 8%

New Zealand equity unit fund 7% 7%

Overseas equity unit fund 33% 25%

Commodities fund 3% 3%

Other assets 2% 3%

100% 100%

None of the above relate to the Company’s own financial instruments, nor property occupied by or other assets used by the Company.

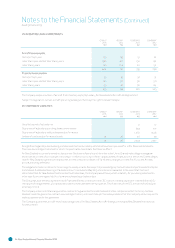

Assumptions used

The following table provides the weighted average assumptions used by the actuaries to develop the net periodic pension cost and the

actuarial present value of projected benefit obligations for the Group’s plans:

GROUP AND COMPANY

Gross discount rate (year 1) 2.9% 2.2%

Gross discount rate (long term) 5.2% 5.2%

Expected return on plan assets 3.5% 3.9%

Future base salary increases 3.3% 3.3%

The expected rates of return on individual categories of plan assets are determined by independent actuaries with reference to relevant

indices published by the New Zealand Stock Exchange. The overall expected rate of return is calculated by weighting the individual rates in

accordance with the anticipated balance in the plan’s investment portfolio.

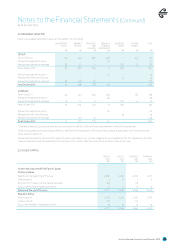

Defined contribution plans

The Group operates defined contribution retirement plans for qualifying employees. The assets of the plan are held separately from

those of the Group and invested in funds under the control of trustees. Employees receive a benefit on retirement or upon resignation,

based upon the employee’s accumulated contributions plus a proportion of the company’s contributions depending upon their period of

membership. Where employees leave service prior to vesting fully in the contributions, the forfeited contributions are retained in the plan

and may be used by the plan to meet expenses, fund the company’s future contributions or provide other benefits for members.

The Group contributes to the NPF Defined Benefit Plan Contributors retirement plan, to which other employers contribute in respect of

their own employees. This has been accounted for as a defined contribution plan as insufficient information is available to allocate the

plan across all participants on a meaningful basis. The Group is not a dominant participant in the plan, contributing approximately 13.1%

of the plan’s total annual contributions (30 June 2012: 11.3%). The information in respect of 2013 presented below is the same as that

disclosed for 2012 as the actuarial valuation for the scheme was not available at the time of preparing these financial statements.

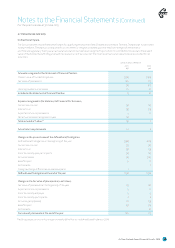

GROUP AND COMPANY

M

M

Overall position of the plan in respect of all employers:

Present value of defined benefit obligation (239) (239)

Fair value of plan assets 259 259

Past service surplus 20 20

The past service surplus of the plan is actuarially valued each year using the aained age valuation methodology. Participating employers

are contractually obliged to contribute at rates specified by the trustee who act on the advice of the actuary. The agreed contribution

requirements seek to fund any deficit over the future working lifetime of the members. Should the fund be in deficit at the time of winding

up the scheme, the Group would be obliged to fund its share of that deficit.

Contributions of $40 million were made to Group defined contribution plans during the year (30 June 2012: $39 million). Contributions of

$34 million were made to Company defined contribution plans during the year (30 June 2012: $33 million).

Notes to the Financial Statements (Continued)

For the year to and as at 30 June 2013