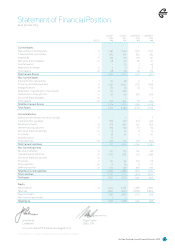

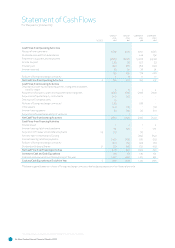

Air New Zealand 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

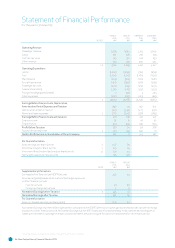

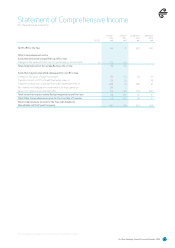

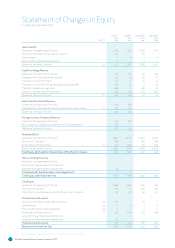

Air New Zealand Annual Financial Results 11

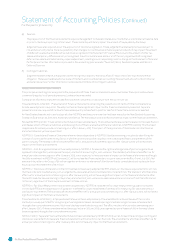

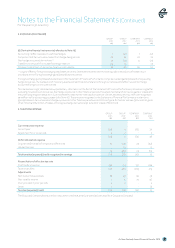

Financial Assets

Cash and cash equivalents

Cash and cash equivalents include cash on hand, demand deposits, current accounts in banks net of overdras and other short-term

highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes

in value.

Trade and other receivables

Trade and other receivables are recognised at cost less any provision for impairment. A provision for impairment is established when

collection is considered to be doubtful. When a trade receivable is considered uncollectible, it is wrien-off against the provision.

Interest-bearing assets

Interest-bearing assets are measured at amortised cost using the effective interest method, less any impairment.

Non interest-bearing assets

Non interest-bearing assets are measured at amortised cost, less any impairment.

Investment in quoted equity instruments

Changes in the fair value of investments in quoted equity instruments, including any related foreign exchange component, are recognised

through other comprehensive income where an irrevocable election has been made at inception to do so. This election is made in order to

ensure the appropriate representation of long-term, strategic investments as distinct from those held for trading. Dividends from such

investments are recognised in profit or loss when the right to receive payment has been established. The cumulative gains or losses held

in other comprehensive income are not transferred to profit or loss on derecognition or otherwise, although they may be transferred

within equity.

Amounts owing from subsidiaries, joint ventures and associates

Amounts owing from related parties are recognised at cost less any provision for impairment. A provision for impairment is established

when collection is considered to be doubtful. When an amount owing from a related party is considered uncollectible, it is wrien-off

against the provision.

Financial Liabilities

Interest-bearing liabilities

Borrowings and Bonds

Borrowings and Bonds are initially recognised at fair value, net of transaction costs incurred. They are subsequently stated at amortised

cost using the effective interest rate method, where appropriate. Borrowings and Bonds are classified as current liabilities unless the

Group has an unconditional right to defer selement of the liability for more than 12 months aer the balance sheet date.

Finance leases

Finance lease obligations are initially stated at fair value, net of transaction costs incurred. The obligations are subsequently stated at

amortised cost.

Trade and other payables

Trade and other payables are stated at cost.

Amounts owing to subsidiaries, joint ventures and associates

Amounts owing to related parties are stated at cost.

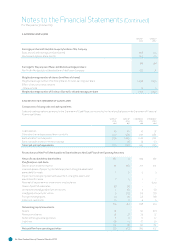

DERIVATIVE FINANCIAL INSTRUMENTS

Air New Zealand uses derivative financial instruments to manage its exposure to foreign exchange, fuel price, and interest rate risks

arising from operational, financing and investment activities. Equity derivatives are used to provide price protection in the event of a

further purchase of shares in Virgin Australia Holdings Limited. Derivative financial instruments are recognised initially at fair value

and transaction costs are expensed immediately. Subsequent to initial recognition, derivative financial instruments are recognised as

described below:

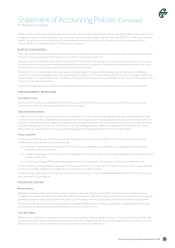

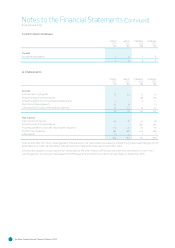

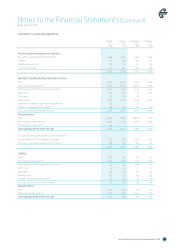

Statement of Accounting Policies (Continued)

For the year to 30 June 2013