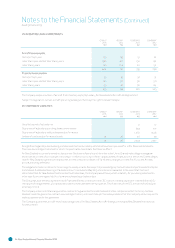

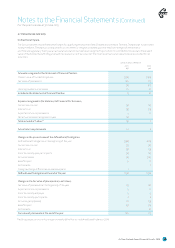

Air New Zealand 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results

44

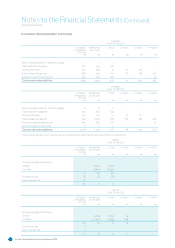

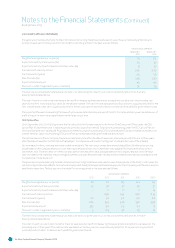

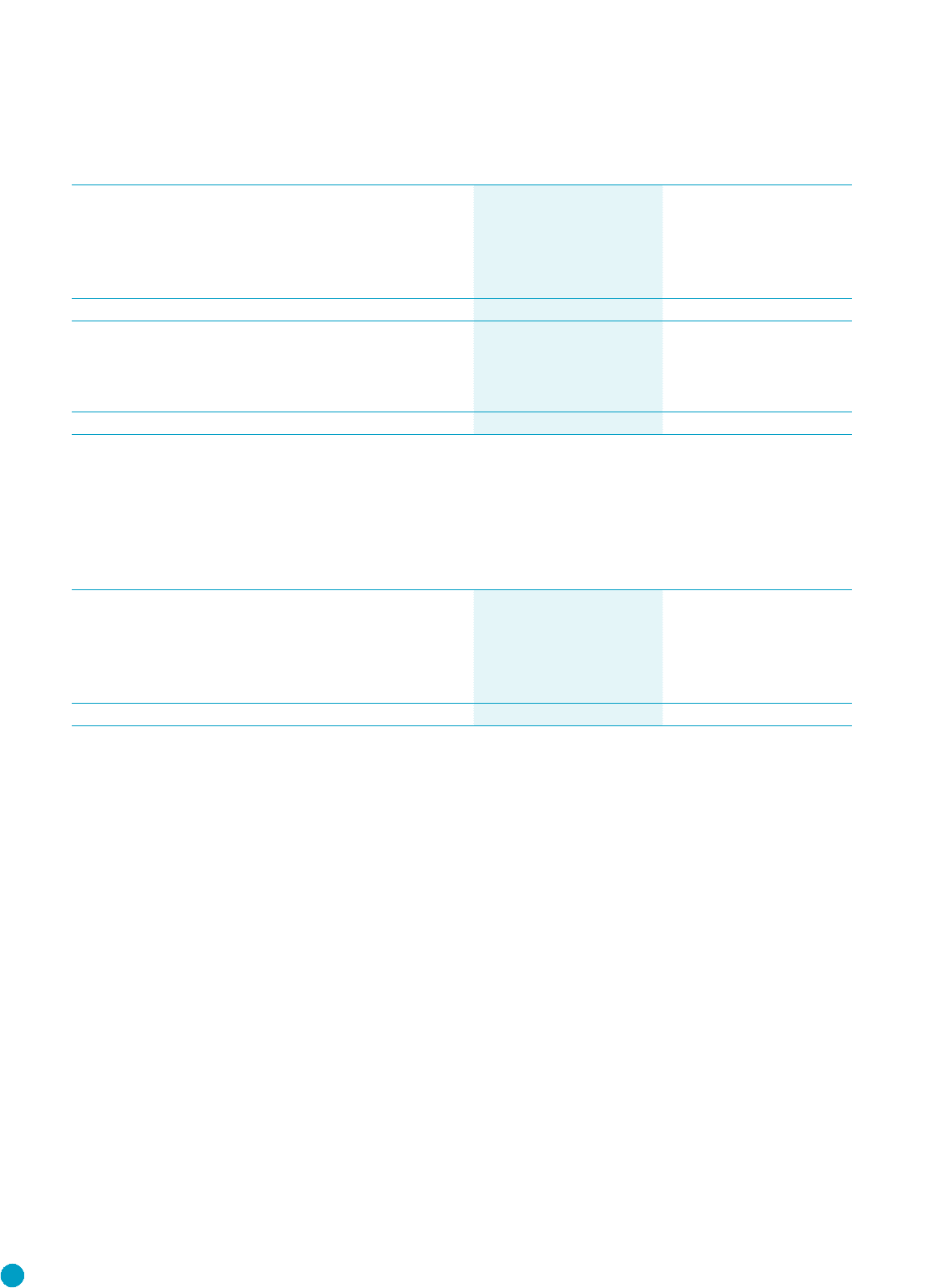

. OPERATING LEASE COMMITMENTS

GROUP

M

GROUP

M

COMPANY

M

COMPANY

M

Aircra leases payable

Not later than 1 year 135 139 51 42

Later than 1 year and not later than 5 years 586 467 194 142

Later than 5 years 123 164 110 54

844 770 355 238

Property leases payable

Not later than 1 year 35 35 32 31

Later than 1 year and not later than 5 years 105 96 98 90

Later than 5 years 93 87 90 84

233 218 220 205

The Company leases a number of aircra from its wholly owned subsidiary, Air New Zealand Aircra Holdings Limited.

Subject to negotiation, certain aircra operating leases give the Group the right to renew the lease.

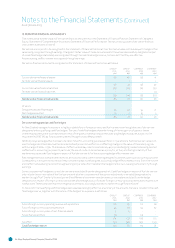

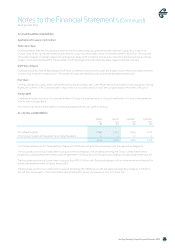

26. CONTINGENT LIABILITIES

GROUP

M

GROUP

M

COMPANY

M

COMPANY

M

Uncalled capital of subsidiaries - - 12 12

Guarantee of subsidiary operating lease commitments - - 853 777

Guarantee of subsidiary indebtedness and performance - - 1,482 1,548

Leers of credit and performance bonds 51 26 46 20

51 26 2,393 2,357

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements.

There are no contingent liabilities for which it is practicable to estimate the financial effect.

Air New Zealand is currently named in class actions. Two (one in Australia and the other in the United States) make allegations against

more than 30 airlines, of anti competitive conduct in relation to pricing in the air cargo business. A class action in the United States alleges

that Air New Zealand together with many other airlines conspired in respect of fares and surcharges on trans-Pacific routes. All class

actions are being defended.

The allegations made in relation to the air cargo business are also the subject of proceedings by the Australian Competition and Consumer

Commission. A defended hearing in the Federal Court concluded in May 2013 and a decision is awaited. In the event that the Court

determined that Air New Zealand had breached Australian laws, the Company would have potential liability for pecuniary penalties. No

other significant contingent liability claims are outstanding at balance date.

The Group has a partnership agreement with Pra and Whitney in relation to the CEC in which it holds a 49 percent interest (Note 14). By

the nature of the agreement, joint and several liability exists between the two parties. Total liabilities of the CEC are $47 million (30 June

2012: $39 million).

The Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within the Group. Air New

Zealand treats the guarantee contract as a contingent liability until such time as it becomes probable that the Company will be required to

make a payment under the guarantee.

The Company guarantees aircra end of lease obligations of Air New Zealand Aircra Holdings Limited and New Zealand International

Airlines Limited.

Notes to the Financial Statements (Continued)

As at 30 June 2013