Air New Zealand 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results

10

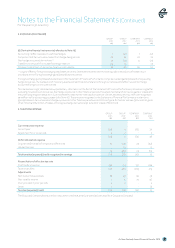

Other revenue

Other revenue is recognised at the time the service is provided.

Loyalty programmes

The fair value of revenues associated with the award of Airpoints Dollars to Airpoints members as part of the initial sales transaction is

deferred, net of estimated expiry (non-redeemed Airpoints Dollars), until the Airpoints member has redeemed their points. The fair value

of consideration received in respect of sales of Airpoints Dollars to third parties is deferred, net of estimated expiry, until such time as the

Airpoints member has redeemed their points.

The estimate of expiry is based upon historical experience and is recognised in net passenger revenue at the time of the initial sales

transaction.

Deferred Airpoints revenue is recorded within revenue in advance in the Statement of Financial Position.

Investment revenue

Dividend revenue is recognised when the right to receive payment is established.

Interest revenue from investments and fixed deposits is recognised as it accrues, using the effective interest method where appropriate.

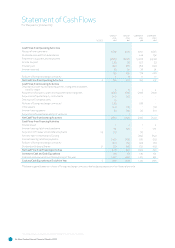

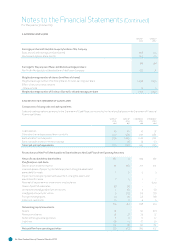

CASH FLOWS

Cash flows are included in the Statement of Cash Flows net of Goods and Services Tax.

BORROWING COSTS

Borrowing costs directly aributable to the acquisition of qualifying assets, such as aircra, are added to the cost of those assets

until such time as the assets are substantially ready for their intended use or sale. Qualifying assets are assets which necessarily take

a substantial period of time to get ready for their intended use. All other borrowing costs are recognised in the Statement of Financial

Performance in the period in which they are incurred.

LEASE PAYMENTS

Operating leases

Leases under which a significant proportion of the risks and rewards of ownership are retained by the lessor are classified as operating

leases. Payments made under operating leases (net of any incentives received) are recognised as an expense in the Statement of Financial

Performance on a straight-line basis over the term of the lease.

Finance leases

Payments made under finance leases are apportioned between the finance expense and the reduction of the outstanding liability. The

finance expense is allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining

balance of the liability.

MAINTENANCE COSTS

The cost of major engine overhauls for aircra owned by the Group is capitalised and depreciated over the period to the next expected

inspection or overhaul.

Where there is a commitment to maintain aircra held under operating lease arrangements, a provision is made during the lease term for

the lease return obligations specified within those lease agreements. The provision is based upon historical experience, manufacturers’

advice and, where appropriate, contractual obligations in determining the present value of the estimated future costs of major airframe

inspections and engine overhauls by making appropriate charges to the Statement of Financial Performance, calculated by reference to

the number of hours or cycles operated during the year.

All other maintenance costs are expensed as incurred.

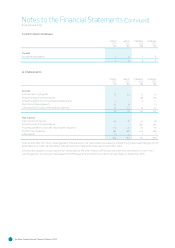

FINANCIAL INSTRUMENTS

Non-derivative financial instruments

Non-derivative financial instruments include cash and cash equivalents, trade and other receivables (excluding prepayments), amounts

owing from related parties, interest-bearing assets, non interest-bearing assets, investment in quoted equity instruments, interest-

bearing liabilities, trade and other payables and amounts owing to related parties. These are recognised initially at fair value plus

any directly aributable transaction costs. Subsequent to initial recognition, non-derivative financial instruments are recognised as

described below.

Statement of Accounting Policies (Continued)

For the year to 30 June 2013