Air New Zealand 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results 39

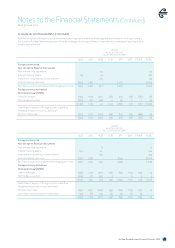

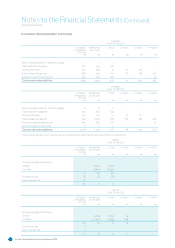

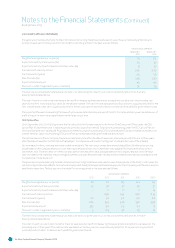

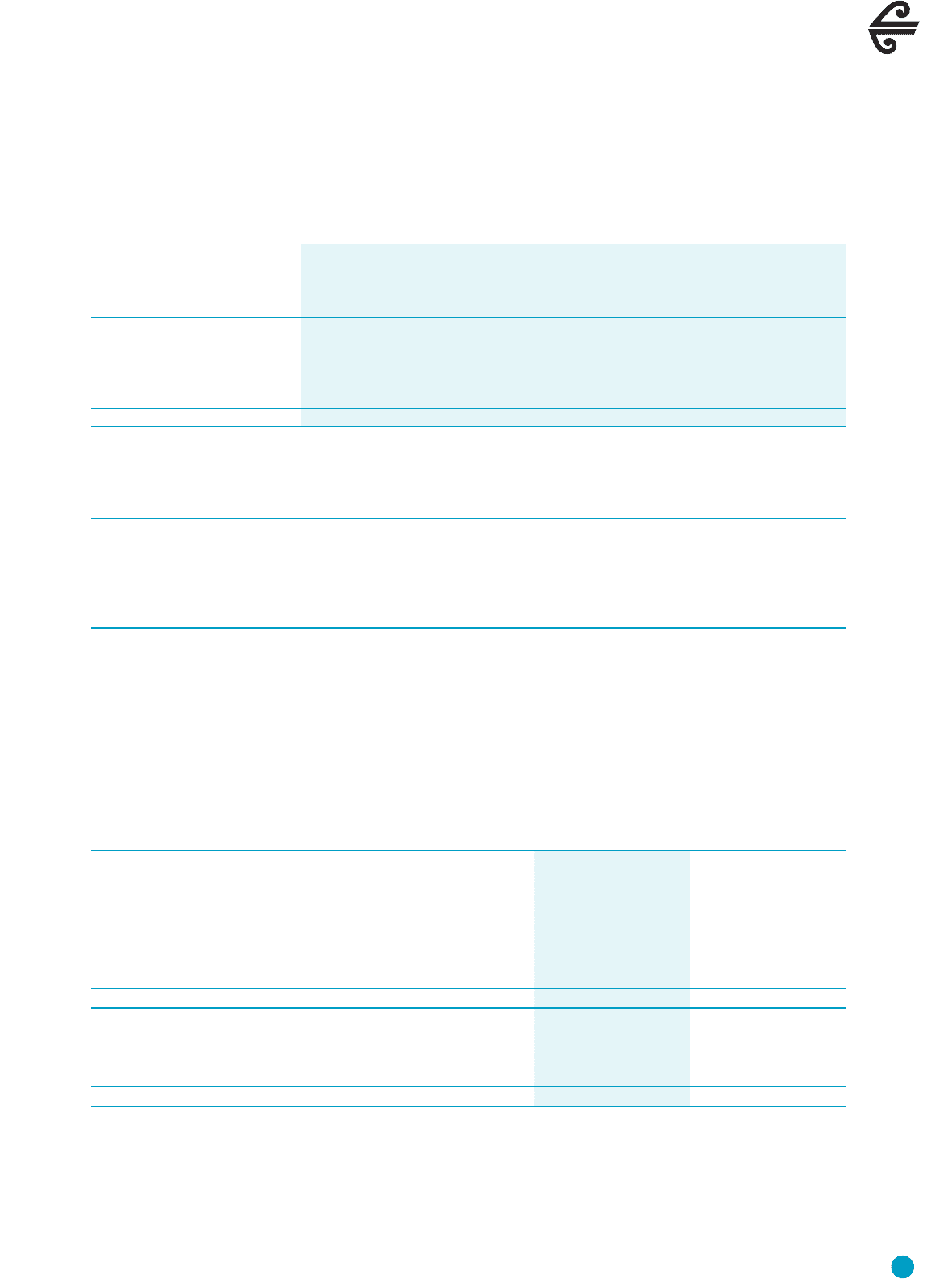

. DEFERRED TAXATION

Deferred tax assets and liabilities are aributable to the following:

NONAIRCRAFT

ASSETS

M

AIRCRAFT

RELATED

M

PROVISIONS

AND

ACCRUALS

M

DERIVATIVE

FINANCIAL

INSTRUMENTS

M

UNUSED TAX

LOSSES

M

TA X R ATE

CHANGE*

M

TOTAL

M

GROUP

As at 1 July 2011

30 323 (81) (26) - (15) 231

Amounts recognised in equity

- - - 37 - - 37

Amounts recognised in earnings

(5) 23 9 - (13) 15 29

As at 30 June 2012

25 346 (72) 11 (13) - 297

Amounts recognised in equity

- - - 19 - - 19

Reclassified to Income Taxation

- - - - 13 - 13

Amounts recognised in earnings

(2) (12) (5) - - - (19)

As at 30 June 2013

23 334 (77) 30 - - 310

COMPANY

As at 1 July 2011

24 225 (79) (29) - (8) 133

Amounts recognised in equity

- - - 38 - - 38

Amounts recognised in earnings

(3) 19 8 - (13) 8 19

As at 30 June 2012

21 244 (71) 9 (13) - 190

Amounts recognised in equity

- - - 20 - - 20

Reclassified to Income Taxation

- - - - 13 - 13

Amounts recognised in earnings

- (21) (2) - - - (23)

As at 30 June 2013

21 223 (73) 29 - - 200

* The New Zealand corporate income tax rate reduced from 30% to 28% at the commencement of the 2012 income year.

Deferred tax assets and liabilities are offset on the face of the Statement of Financial Position where they relate to entities within the

same taxation authority.

Unused tax losses of Nil (30 June 2012: $48 million) are available to carry forward against future taxable profits. Tax losses from the 2012

financial year have been reclassified to “Income Taxation” to reflect that they will be fully utilised in the current year.

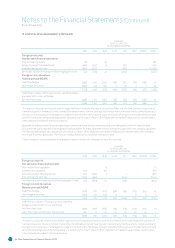

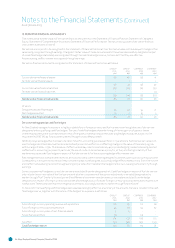

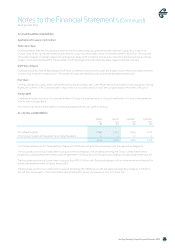

. ISSUED CAPITAL

GROUP

M

GROUP

M

COMPANY

M

COMPANY

M

Authorised, Issued and Fully Paid in Capital

Ordinary Shares

Balance at the beginning of the year 2,282 2,269 2,290 2,277

Shares issued 1 8 1 8

Acquisition of treasury stock (share buyback) (11) - (11) -

Equity-seled share-based payments 5 5 5 5

Balance at the end of the year 2,277 2,282 2,285 2,290

Represented by:

Paid in capital 2,273 2,267 2,281 2,275

Treasury stock (11) - (11) -

Equity-seled share-based payments 15 15 15 15

2,277 2,282 2,285 2,290

Notes to the Financial Statements (Continued)

As at 30 June 2013