Air New Zealand 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results 41

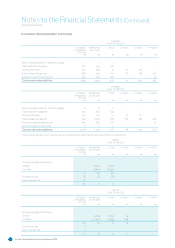

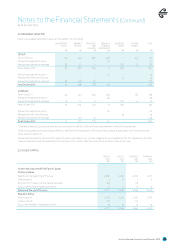

. ISSUED CAPITAL CONTINUED

Long Term Incentive Plan (LTIP)

On 21 September 2012, 21,610,275 options (issue 1) with a fair value of $4.0 million were issued to executives under the LTIP (16 September 2011:

19,991,539 options with a fair value of $3.8 million). On 21 December 2012 a further 4,000,000 options (issue 2) with a fair value of $1,112,000

were issued. Total options outstanding under the LTIP are 66,837,243 (30 June 2012: 60,679,081). The unamortised fair value of outstanding

LTIP options (measured at grant date) is $5.0 million (30 June 2012: $4.2 million).

The options may be exercised at any time between three and five years aer the date of issue (subject to compliance with insider trading

restrictions and the rules of the scheme), but may lapse if the participants leave the Group in certain specified circumstances. The 2013

issue 2 options may be exercised at any time between 21 September 2015 and 21 September 2017 (subject to compliance with insider trading

restrictions and the rules of the scheme).

The exercise price will be set three years aer issue, and will be based on the Company share price at the issue date increased or decreased

by the percentage movement in a specified index over the three years, and decreased by any distributions made by the Company over the

same period. The specified index comprises the total shareholder return for the NZSX All Gross Index and the Bloomberg World Airline Total

Return Index in 50:50 proportions.

The general principles underlying the Black Scholes option pricing model have been used to value these options using a Monte Carlo

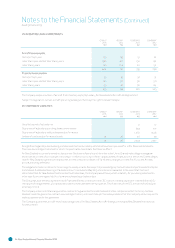

simulation approach. The key inputs to this model for options granted in that year were as follows:

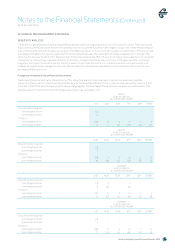

GROUP AND COMPANY

ISSUE

ISSUE

Weighted average share price (cents) 112 146 111 129 124 114

Expected volatility of share price (%) 30 30 35 37 40 37

Expected volatility of performance benchmark index (%) 15 15 17 17 17 15

Correlation of volatility indices 0.20 0.25 0.45 0.45 0.50 0.45

Contractual life (years) 5.0 4.8 5.0 5.0 5.0 5.0

Risk free rate (%) 3.10 3.30 4.09 4.72 5.50 5.90

Expected dividend yield 4.9 3.8 5.0 5.4 5.2 7.5

Discount to reflect negotiability restrictions (%) 25 25 25 25 25 25

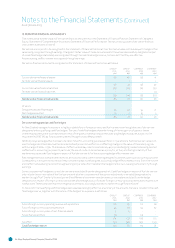

The exercise price has been modelled as a stochastic variable, using the volatility, correlation, dividend yield and risk free rate

assumptions detailed above.

The volatility and correlation estimates were derived from measuring these parameters using historical data over the preceding three

to five years. The risk free rate was based on the five year zero coupon bond yield implied from short to medium term yields for

government bonds.

The expected life used in calculating the value of options was determined by analysis of the arition rates and early exercise behaviour

of staff in long term incentive programmes in similar large corporates.

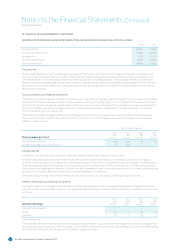

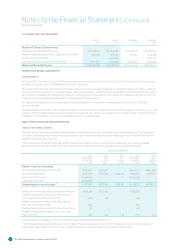

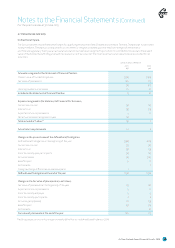

CFO Option Plan

On 21 September 2012, 2,399,138 options with a fair value of $0.4 million were issued to the Chief Financial Officer under the CFO Option

Plan. The options were issued in two tranches, with 50 percent of the options being allocated to each tranche. Total options outstanding

under the CFO Option Plan are 2,399,138. The unamortised fair value of outstanding CFO Option Plan options (measured at grant date) is

$0.3 million.

The first tranche of options may be exercised at any time between two to four years aer the date of issue for the CFO Option Plan and

the second tranche between four to six years aer the date of issue for the CFO Option Plan (subject to compliance with insider trading

restrictions and the rules of the scheme), but may lapse if the participant leaves the Group in certain specified circumstances.

The exercise price will be set for the first tranche two years aer issue, and the second tranche four years aer issue, and will be

based on the Company share price at the issue date increased or decreased by the percentage movement in a specified index over the

vesting period, and decreased by any distributions made by the Company over the same period. The specified index comprises the total

shareholder return for the NZSX All Gross Index and the Bloomberg World Airline Total Return Index in 50:50 proportions.

Notes to the Financial Statements (Continued)

As at 30 June 2013