Air New Zealand 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results

14

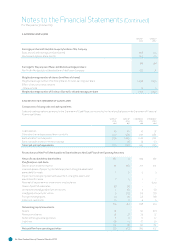

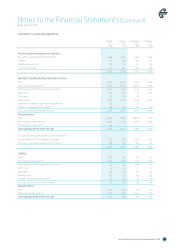

Impairment of non-financial assets

Non-financial assets are reviewed at each reporting date to determine whether there are any indicators that the carrying amount may

not be recoverable. If any such indicators exist, the asset’s recoverable amount is estimated. The recoverable amount is the higher of

an asset’s fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their

present value using a discount rate that reflects current market assessments of the time value of money and the risks specific to the

asset. An impairment loss is recognised in the Statement of Financial Performance for the amount by which the asset’s carrying amount

exceeds its recoverable amount. For the purposes of assessing impairment, assets are grouped at the lowest level for which there are

separately identifiable cash flows (cash-generating units).

Aircra are operated by the airline as a single network and are assessed for impairment as one cash-generating unit, inclusive of

related infrastructural assets. Estimated net cash flows used in determining recoverable amounts are based on the directors’ current

assessment of the Group’s future trading prospects and the assets’ ultimate net sale proceeds and have been discounted to their net

present value. Aircra which have been withdrawn from service and have no intention of being reintroduced into the operating fleet, or

there has been a significant decline in operating requirements, are assessed for impairment on an individual basis.

Where an impairment loss subsequently reverses, the carrying amount of the asset or cash-generating unit is increased to the revised

estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have

been determined had no impairment loss been recognised in prior years.

ASSETS HELD FOR RESALE

Non-current assets are classified as held for resale if their carrying amount will be recovered through a sale transaction rather than

through continuing use. The sale must be highly probable and the asset available for immediate sale in its present condition. Management

must be commied to the sale, which should be expected to qualify for recognition as a completed sale within one year from the date of

classification.

Non-current assets classified as held for resale are measured at the lower of the asset’s previous carrying amount and its fair value less

costs to sell.

WORK IN PROGRESS

Contract work in progress is stated at cost plus the profit recognised to date, using the percentage of completion method, less any

amounts invoiced to customers. Cost includes all expenses directly related to specific contracts and an allocation of direct production

overhead expenses incurred.

Capital work in progress includes the cost of materials, services, labour and direct production overheads.

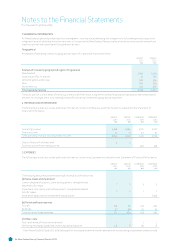

INVENTORIES

Inventories are measured at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO) cost method.

Net realisable value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses.

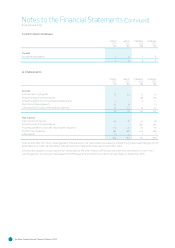

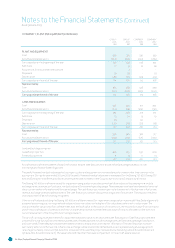

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs directly aributable to the issue of new shares or options are shown in equity

as a deduction, net of taxation, from the proceeds.

Where a member of the Group purchases the Company’s share capital, the consideration paid is deducted from equity under the treasury

stock method, until they are reissued or otherwise disposed of.

TREASURY STOCK

When shares are acquired by the Company, the amount of consideration paid is recognised directly in equity. Acquired shares are

classified as treasury stock and presented as a deduction from issued capital. When treasury stock are subsequently sold or reissued

pursuant to equity compensation plans, the cost of treasury stock is reversed and the realised gain or loss on sale or reissue, net of any

directly aributable incremental transaction costs, is recognised within issued capital.

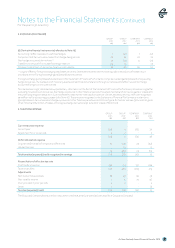

RESERVES

Cash flow hedge reserve

The cash flow hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging

instruments related to hedged transactions that have not yet occurred.

Foreign currency translation reserve

The foreign currency translation reserve comprises foreign exchange differences arising on consolidation of foreign operations together

with the translation of foreign currency borrowings designated as a hedge of net investments in those foreign operations.

Statement of Accounting Policies (Continued)

For the year to 30 June 2013