Air New Zealand 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Air New Zealand Annual Financial Results 17

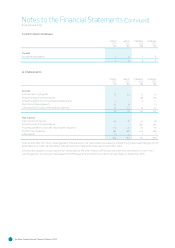

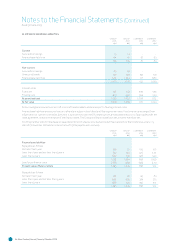

. EXPENSES CONTINUED

GROUP

M

GROUP

M

COMPANY

M

COMPANY

M

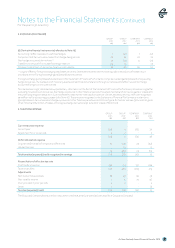

(d) Derivative financial instruments (refer also to Note 19)

Accounting ineffectiveness on cash flow hedges

7 (12) 7 (12)

Components of derivatives excluded from hedge designations 22 24 22 24

Non-hedge accounted derivatives **

12 (21) 9 (21)

Transfers to net profit from cash flow hedge reserve

(5) 75 - 78

Total earnings impact of derivative financial instruments

36 66 38 69

** Largely offset by foreign exchange gains/losses on United States denominated interest-bearing liabilities and aircra lease return

provisions within “Foreign exchange gains/(losses)” as noted below.

“Foreign exchange gains/(losses)” as disclosed in the Statement of Financial Performance comprise realised gains/(losses) from operating

hedge derivatives, the translation of monetary assets and liabilities denominated in foreign currencies and ineffective and non-hedge

accounted foreign currency derivatives.

“Normalised earnings”, disclosed as supplementary information at the foot of the Statement of Financial Performance, shows earnings aer

excluding movements on derivatives that hedge exposures in other financial periods. The adjustments match derivative gains or losses with

the underlying hedged transaction. Such movements comprise the time value on open derivatives and amounts required to be recognised

as ineffective for accounting purposes (refer Note 19). The amounts recognised in the Statement of Financial Performance in relation to

(gains)/losses on derivatives which hedge exposures in other financial periods are $2 million of gains for fuel derivatives (30 June 2012: gains

of $11 million) and $2 million of losses on foreign exchange derivatives (30 June 2012: losses of $8 million).

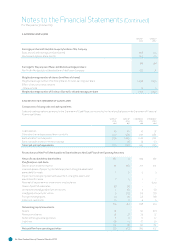

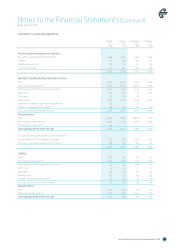

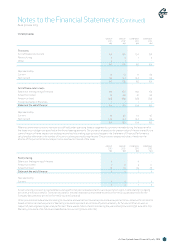

. TAXATION EXPENSE

GROUP

M

GROUP

M

COMPANY

M

COMPANY

M

Current taxation expense

Current year (95) 4 (65) 34

Adjustment for prior periods 2 2 - 4

(93) 6 (65) 38

Deferred taxation expense

Origination/(reversal) of temporary differences 19 (42) 23 (32)

Unused tax loss - 13 - 13

19 (29) 23 (19)

Total taxation (expense)/credit recognised in earnings

(74) (23) (42) 19

Reconciliation of effective tax rate

Profit before taxation 256 94 391 268

Taxation at 28% (72) (26) (109) (75)

Adjustments

Non-deductible expenses (6) (4) (3) (3)

Non-taxable income 1 5 70 96

Over provided in prior periods 2 2 - 2

Other 1 - - (1)

Taxation (expense)/credit (74) (23) (42) 19

The Group and Company have $41 million imputation credits as at 30 June 2013 (30 June 2012: Nil in Group and Company).

Notes to the Financial Statements (Continued)

For the year to 30 June 2013