2K Sports 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

equal in right of payment to our existing and future indebtedness that is not so subordinated; junior in right

of payment to any of our secured indebtedness to the extent of the value of the assets securing such

indebtedness; and structurally junior to all existing and future indebtedness incurred by our subsidiaries.

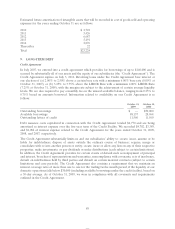

In connection with the offering of the Convertible Notes, we entered into convertible note hedge

transactions which are expected to reduce the potential dilution to our common stock upon conversion of

the Convertible Notes. The convertible note hedge transactions allow the Company to receive shares of its

common stock related to the excess conversion value that it would convey to the holders of the Convertible

Notes upon conversion. The transactions include options to purchase approximately 12,927,000 shares of

common stock at $10.675 per share, expiring on June 1, 2014, for a total cost of approximately $43,600,

which was charged to additional paid-in capital.

Separately, the Company entered into a warrant transaction with a strike price of $14.945 per share. The

warrants will be net share settled and will cover approximately 12,927,000 shares of the Company’s

common stock and expire on August 30, 2014, for total proceeds of approximately $26,300, which was

charged to additional paid-in capital.

A portion of the net proceeds from the Convertible Notes offering was used to pay the net cost of the

convertible note hedge transactions (after such cost was partially offset by proceeds from the sale of the

warrants). We incurred approximately $4,984 of banking, legal and accounting fees related to the issuance

of the Convertible Notes which were capitalized as debt issuance costs and will be amortized to interest

and other expense, net over the five year term of the Convertible Notes. We recorded $2,930 of interest

expense related to the Convertible Notes for the year ended October 31, 2009. See Note 12 for a summary

of the annual commitments as of October 31, 2009 related to the Convertible Notes and interest.

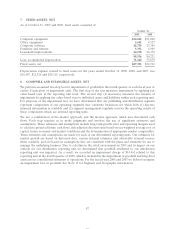

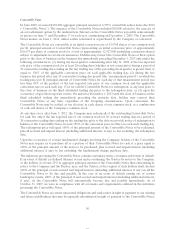

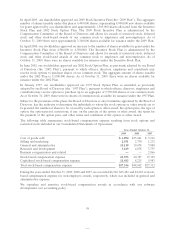

10. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities as of October 31, 2009 and 2008 consisted of:

October 31,

2009 2008

Software development costs and royalties $ 55,151 $ 39,803

Income tax payable and deferred tax liability 41,669 13,263

Compensation and benefits 17,373 40,293

Licenses 13,202 13,594

Marketing and promotions 11,100 7,430

Professional fees 6,210 7,618

Rent and deferred rent obligations 5,854 6,732

Deferred consideration for acquisitions 1,103 921

Other 23,321 23,435

Total $174,983 $153,089

11. LEGAL AND OTHER PROCEEDINGS

Various lawsuits, claims, proceedings and investigations are pending involving us and certain of our

subsidiaries as described below in this section. Depending on the amount and the timing, an unfavorable

resolution of some or all of these matters could materially affect our business, financial condition, results

of operations or cash flows. We have appropriately accrued amounts related to certain legal and other

proceedings discussed below. While there is a possibility that a loss may be incurred in excess of the

amounts accrued in our financial statements, we believe that such losses, unless otherwise disclosed, would

not be material. In addition to the matters described herein, we are, or may become, involved in routine

91