2K Sports 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

titles, and achievements based on sales of specific titles. The goodwill recorded in connection with this

acquisition is deductible for tax purposes.

In December 2007, we acquired all of the outstanding capital stock of 2K Czech, formerly known as

Illusion Softworks, a.s. (‘‘2K Czech’’), the Czech Republic developer of the Mafia video game franchise.

The acquisition reflects our strategy to add high-value intellectual property and development studios to our

portfolio. Total consideration paid upon acquisition was $32,908, consisting primarily of 1,496,647 shares of

our unregistered common stock and $4,645 of development advances paid prior to the acquisition. The

terms of the transaction also include additional contingent deferred payments in cash and stock of up to

$10,000, which is expected to be allocated between purchase price and employee compensation expense

when the conditions requiring their payment are met. The goodwill recorded in connection with this

acquisition is not deductible for tax purposes.

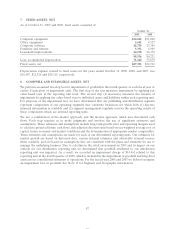

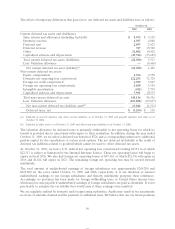

5. INVENTORY

As of October 31, 2009 and 2008, inventory consisted of:

October 31, October 31,

2009 2008

Finished products $83,637 $ 96,139

Parts and supplies 10,359 8,096

Inventory $93,996 $104,235

Estimated product returns included in inventory at October 31, 2009 and 2008 were $7,089 and $9,394,

respectively.

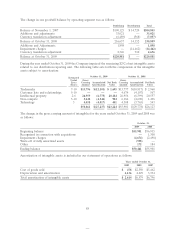

6. SOFTWARE DEVELOPMENT COSTS AND LICENSES

Details of our capitalized software development costs and licenses were as follows:

October 31, 2009 October 31, 2008

Current Non-current Current Non-current

Software development costs, internally developed $123,018 $46,574 $ 72,381 $39,508

Software development costs, externally developed 42,306 27,202 37,422 20,495

Licenses 2,017 1,745 3,633 1,988

Software development costs and licenses $167,341 $75,521 $113,436 $61,991

Software development costs and licenses as of October 31, 2009 and October 31, 2008 included $212,939

and $136,687, respectively, related to titles that have not been released.

Amortization and impairment of software development costs and licenses for the years ended October 31,

2009, 2008 and 2007 were as follows:

October 31,

2009 2008 2007

Amortization and impairment of software development costs and

licenses $111,615 $159,563 $109,891

Less: Portion representing stock-based compensation (6,094) (13,461) (3,216)

Amortization and impairment, net of stock-based compensation $105,521 $146,102 $106,675

86