2K Sports 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4.00% LIBOR Rate (7.25% at October 31, 2009 and October 31, 2008). We are also required to pay a

monthly fee on the unused available balance, ranging from 0.25% to 0.75% based on amounts borrowed.

Availability under the Credit Agreement is restricted by our domestic and United Kingdom based accounts

receivable and inventory balances. The Credit Agreement also allows for the issuance of letters of credit in

an aggregate amount of up to $25.0 million.

On May 28, 2009, we paid down all of the outstanding borrowings on our Credit Agreement. As of

October 31, 2009 there were no outstanding borrowings and $88.1 million was available for borrowings. We

had $11.6 million of letters of credit outstanding at October 31, 2009 and were in compliance with all

covenants and requirements in the Credit Agreement.

The Credit Agreement substantially limits us and our subsidiaries’ ability to: create, incur, assume or be

liable for indebtedness; dispose of assets outside the ordinary course of business; acquire, merge or

consolidate with or into another person or entity; create, incur or allow any lien on any of their respective

properties; make investments; or pay dividends or make distributions (each subject to certain limitations).

In addition, the Credit Agreement provides for certain events of default such as nonpayment of principal

and interest, breaches of representations and warranties, noncompliance with covenants, acts of insolvency,

default on indebtedness held by third parties and default on certain material contracts (subject to certain

limitations and cure periods). The Credit Agreement also contains a requirement that we maintain an

interest coverage ratio of more than one to one for the trailing twelve month period, if the liquidity of our

domestic operations falls below $30.0 million (including available borrowings under the credit facility),

based on a 30-day average. As of October 31, 2009, we were in compliance with all covenants and

requirements outlined in the Credit Agreement.

We are subject to credit risks, particularly if any of our receivables represent a limited number of

customers or are concentrated in foreign markets. If we are unable to collect our accounts receivable as

they become due, it could adversely affect our liquidity and working capital position.

Generally, we have been able to collect our accounts receivable in the ordinary course of business. We do

not hold any collateral to secure payment from customers. We have trade credit insurance on the majority

of our customers to mitigate accounts receivable risk.

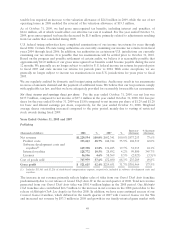

A majority of our trade receivables are derived from sales to major retailers and distributors. Our five

largest customers accounted for 48.0% and 40.2% of net revenue for the years ended October 31, 2009 and

2008, respectively. As of October 31, 2009 and 2008, amounts due from our five largest customers

comprised approximately 56.5% and 39.0% of our gross accounts receivable balance, respectively, with our

significant customers (those that individually comprised more than 10% of our gross accounts receivable

balance) accounting for 47.9% and 11.8% of such balance at October 31, 2009 and 2008, respectively. We

believe that the receivable balances from these largest customers do not represent a significant credit risk

based on past collection experience, although we actively monitor each customer’s credit worthiness and

economic conditions that may impact our customers’ business and access to capital. We are monitoring the

current global economic conditions, including credit markets and other factors as it relates to our

customers in order to manage the risk of uncollectible accounts receivable.

We have entered into various agreements in the ordinary course of business that require substantial cash

commitments over the next several years. Generally, these include:

P ;F99A9BHG HC 57EI=F9 @=79BG9G HC =BH9@@97HI5@ DFCD9FHM GI7< 5G HF589A5F?G 7CDMF=;<HG 5B8

technology for use in the publishing, marketing and distribution of our software titles. Our licensing

and marketing commitments primarily reflect agreements with major sports leagues and players’

associations and expire at various times through September 2014;

P CBHF57HI5@D5MA9BHGHCH<=F8D5FHMGC:HK5F989J9@CD9FGH<5H9LD=F95HJ5F=CIGH=A9GH<FCI;<#IB9

2011. Guaranteed minimum payments assume satisfactory performance;

55